The changes occurring within financial services are indisputable. Technology disruption is real and it’s happening all around us, influencing workforce strategies, capabilities, operations, expense management, as well as employee and customer expectations and behaviors. This is especially true in the property-casualty insurance industry, where the focus lies on people and achieving an optimal customer experience.

In 2016, property-casualty companies saw a clear increase in losses, an increasing combined ratio, fewer reserves released, and higher catastrophe losses. These unfavorable trends were offset with growth in investment income, modest premium growth, and a slight decrease in the expense ratio. While most leaders believe that industry conditions for property-casualty insurance were more difficult in 2017, heightened technology continues to drive the transformation of traditional structures and longstanding industry methods, especially concerning customer experience. Integration of digital strategies and the availability of skill-specific human capital are top of mind for many leaders. New positions have been added to support customer engagement initiatives and specific business strategies are being deployed against emerging customer expectations.

In order to keep up to pace and remain relevant in 2018 and beyond, property-casualty insurance firms must look back at 2017 to compare and adjust their plans before moving full speed ahead. Here are a few key trends to examine from this past year and an overview of what to expect in 2018.

Year-over-Year Comparisons

Let’s set the scene. Looking back at past years, declining investment returns keeps the focus on underwriting results. The industry asset mix is currently comprised of approximately 61% bonds, 22% stocks, and 17% other. U.S. quarterly year-over-year direct premium change reflects growth over the past year remaining steady at around 4.5% through Q3 2017, according to SNL Financial. This is driven largely by greater growth in personal lines, which rests at 6.6%. Property lines and personal and commercial auto are the driving forces behind increases in direct loss ratios.

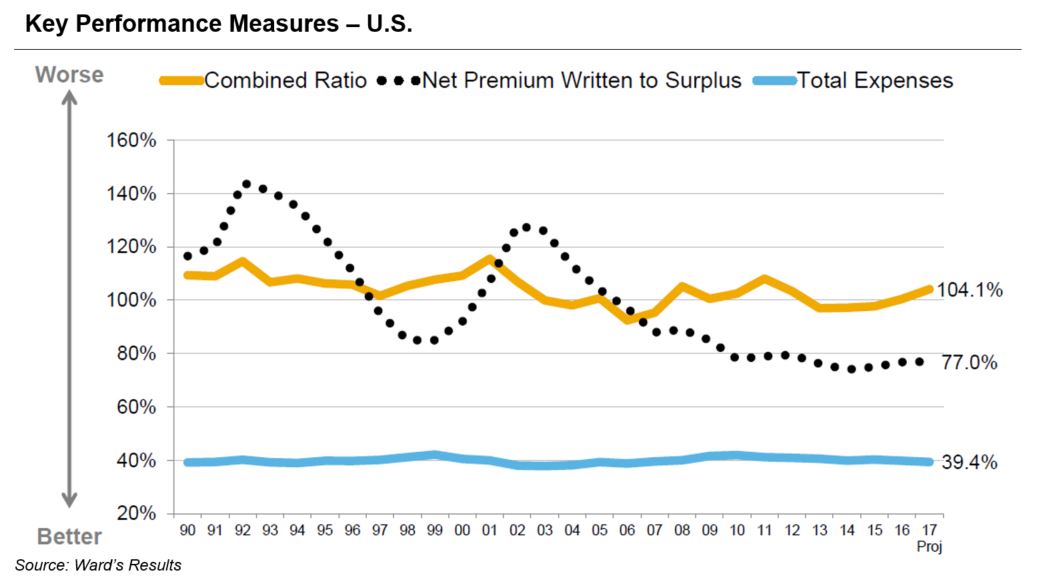

According to Ward Group’s results, projections for key performance measures in the U.S. are based on the first three quarter trends and Q4 projections, and do not anticipate reserve changes by companies. Expenses include underwriting, loss adjusting, and investment expenses.

Source: Ward’s Results

People Trends

In insurance, the greatest companies often shine in the most difficult of times. Therefore, it is necessary to find the right talent to replace an aging workforce and address the changes occurring in the industry as a result of digitization. According to our Labor Market Study, staffing plans increase along with revenue growth and 81% of companies expected an increase in revenue growth, up 11 points from our January 2017 survey.

Unsurprisingly, in our Ward Group Human Capital Survey, 70% of companies indicated that human capital and talent management is one of their top five business priorities over the next five years. We will increasingly see P&C firms focusing on diversity and inclusion, leadership and development, succession planning, career pathing and mobility, as well as human capital analytics. Job role movement as a result of advancing technology is another front of mind topic as insurance companies adjust to the shifting landscape. The majority of changes are predicted to take place in analytics, information technology, and employee relations roles. In terms of attracting new talent, our studies have found that insurance positions are still moderately difficult to fill, particular in analytics, executives, actuarial, technology, underwriting, product management, and compliance.

Across financial services, competition for talent is fierce, as firms are competing for the same talent to fill hot jobs related to technology and customer centricity. Like many other financial services firms, P&C insurance companies are responding by focusing on workforce organization and design, leveraging human capital analytics to define new value propositions and create attractive cultures in an attempt to combat the legacy environment often associated with the industry. Millennials are interested in the total package—not just compensation, but a holistic approach to reward. To meet this demand, insurance firms are rethinking traditional strategies, establishing strong leadership to foster a more flexible, meaningful future workplace.

Expense Trends

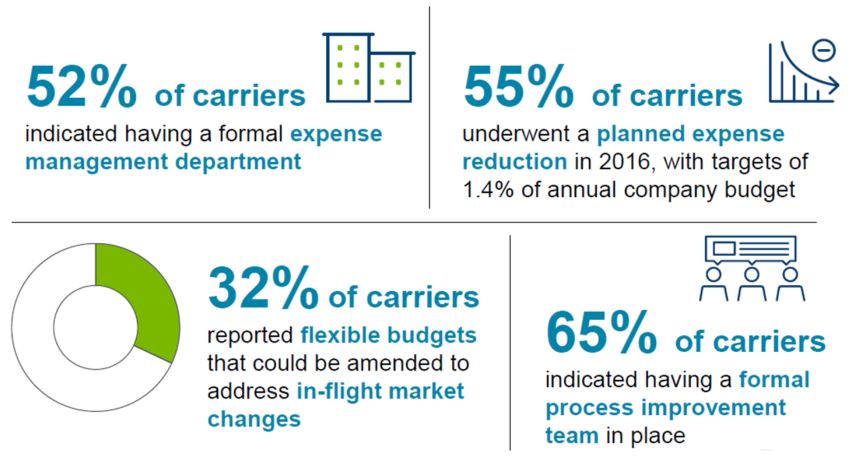

Financial conditions were more difficult in 2017, but positivity lies on the horizon as we begin 2018. To start, revenue growth recently gained stability despite lower growth in policy count. Expense management is currently a top initiative for many P&C insurance firms. According to our Expense Management Survey, carriers are becoming more tactical in their approach to expense management, no longer decreeing across board cuts when a reduction initiative is needed. Preparing a successful future for your firm is clearly more than just budgeting.

It is interesting to note that the majority of significant spending growth (15% or more) between 2016 and 2017 occurred in Information Technology, Business Analytics, Actuarial, and Claims Administration. What does this tell us about the current and future state of the industry? Technology is paving the way. As competition for skill-specific talent reaches an all-time high, our studies found that employee costs are also on the rise, with salaries and benefits representing 13.1% of net premiums written across the industry.

Operational Trends

The average number of full time employees (FTE) relative to premiums written has declined over the years. Yet, as the agency business model evolves in an effort to maximize both carrier and agent value propositions, as well as keep up with the latest trends and technological influences, FTE for certain high-demand roles has actually increased. When it comes to marketing departments, for example, carriers are putting more bodies in the field, with one-third of all carriers budgeting for more staff headcount.

Here are three key takeaways from our findings to consider:

Key Takeaway #1: While there have been enhancements to core processing and lowering cost in those areas, there has also been a major increase in cost for skill-specific talent.

We are seeing efficiencies, but these are also being offset by other trends and resulting cost increases. Specifically, the growth of headcount in higher paid technical staff has offset reductions in lower paid clerical roles. Carriers are also applying the best practices learned from personal lines to the commercial side of the house, developing online self-service and policy management tools as a means to set themselves apart from the pack.

Key Takeaway #2: All changes are occurring for the customer experience.

What is the best digital strategy to use to cater to customer experience? That is a common question firms are asking and struggling to define. As technology increases automation, carriers have been challenged to determine what their future-state organization looks like. Insurance companies have increased their expense on all aspects of technology including total IT spend, capital spend, development and maintenance, infrastructure, information security, contractors, and headcount, with the highest increase in cost for information security, coming in at a 31% increase. And there’s no stopping there—technology investments continue at record pace. Firms will use these new advances for projects on multiple fronts all circling back to improving service and the customer experience.

Key Takeaway #3: What does InsurTech actually mean? Firms know this emerging sector is a threat, but are struggling with how to strategically respond.

Over 230 InsurTech companies have launched in recent years. As a result, the insurance sector is being forced to rethink its model due to the rise of these disruptive startups. Customers are seeking instant gratification and convenience, both of which are provided through tech solutions. Should traditional insurance firms collaborate with these new, innovative companies, or solely focus on competition? Regardless of the answer, emerging potential threats such as InsurTech, leads P&C firms to emphasize the importance of fresh recruitment and compensation methods to ensure they are attracting the right talent to satisfy client demand at a comparable pace and remain in the game. In the meantime, IT contingent workers are on the rise to fill the any technology skill gaps. Although temporary, these employees are having quite the impact on insurance firms, as their heightened demand is forcing companies to increase flexibility and broaden the talent they target for the purposes of rewards practices, career pathing, engagement, performance management, and development.

Closing Thoughts

Although there are many questions about the future, when reflecting on past property-casualty insurance trends, one thing is for sure—there should be no letting off of the pedal. The industry must continue to accelerate along with the changing environment. Beyond day-to-day operations, companies are faced with more compliance work, technology disruptions, security concerns, and external competitors; however, with the proper compensation and development plans to attract the right talent, firms can take advantage of the evolving times and create strategies around innovation, artificial intelligence, and machine learning. While there are still challenges to face, the overall future for P&C insurance companies looks bright.

To learn more about past and future property-casualty insurance trends, please contact our team.

Related Articles