As we look across a set of industries—Financial Services, Technology, Fin Tech, and Consulting—we see dramatically different approaches to job architecture in general, and the use of corporate titles in particular.

For purposes of this article, let's define "corporate title" as an indicator of seniority versus a "functional title" denoting specific area of responsibility (e.g., Managing Director vs. Financial Controller).

Overview

In general, we see larger firms as more likely to have defined corporate title structures, although large firms may have a hodgepodge of functional titles, due to growth through acquisition or geographic dispersion. Smaller firms are less likely to have formalized corporate title structures. On an industry basis, we observe the following trends:

Our intention is to explore these different approaches and how they actually serve the individual sectors well, as well as to summarize the emerging challenges of corporate title structures and the key considerations for organizations about to implement or review them. Our hope is that this exploration will serve as a tool to help firms reflect on their own structures, and provide context for thinking about next steps.

Value Proposition

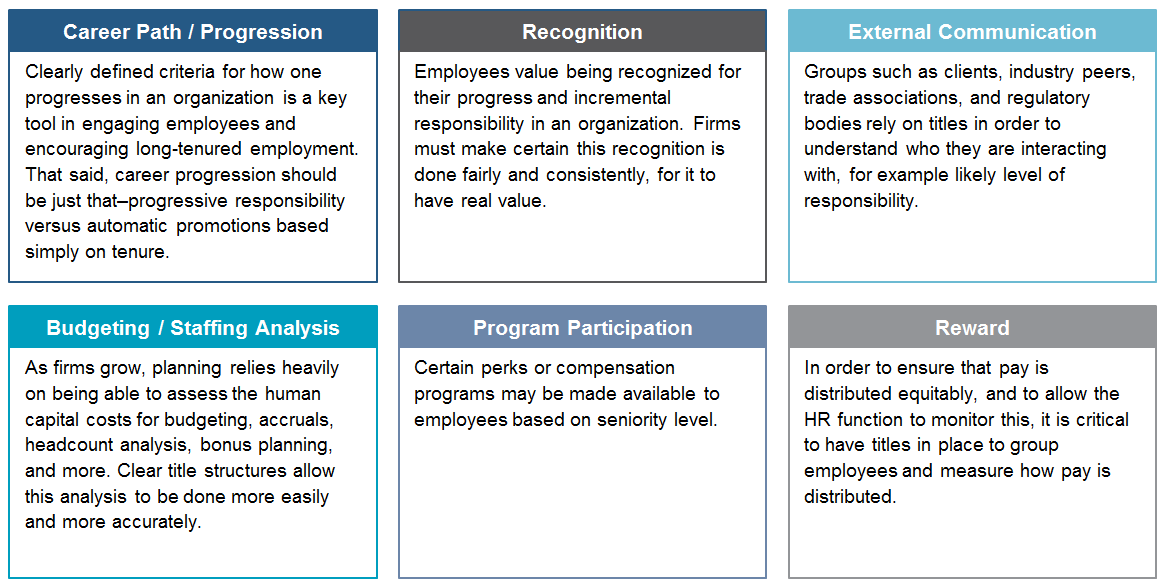

Across all sectors, firms and their employees receive value from having a corporate title structure. First and foremost, a corporate title structure facilitates a shared understanding of the seniority of a firm's employees, and provides a common language to discuss this in. Some of the way firms realize value of this shared understanding include the following:

Challenges

Some firms perceive a formalized corporate title structure as being too corporate, too hierarchical, or too political. As a growing percentage of firms' workforce comprises millennials, a number of firms are concerned that a formalized structure will make it more difficult to recruit this generation of workers—that their firm will be perceived as stuffy or stodgy. Paradoxically, millennials are often viewed as being hyper-focused on career progression—something that is much easier to articulate in the context of a career framework that includes a more formalized title structure.

One important nuance to highlight here, however, is the difference between career advancement and career development as it relates to millennials' focus on progression. The research shows that millennials' expectations for promotion differ from other generations. Millennials expect to be promoted about every two years, whereas other generations' expectations fall within a three to four year time horizon1. This supports the need for organizations to think critically about their title architectures and how the architecture sets the groundwork for a pace of advancement that is rewarding to millennials. At the same time, however, data also tells us that career development opportunities impact millennial retention more than career advancementopportunities1. Career development opportunities include things like formal development programs, mentoring and coaching, opportunities for lateral moves and mobility assignments. The point here is that title structure alone will not serve to attract, retain, and engage this critical population—it's important for organizations to consider a broader definition of "career progression" and ensure managers are having these types of conversations with their talent, with particular focus on millennials.

Financial Services

Financial Services firms tend to have highly structured job architectures, though less so at Asset Management firms. More so than most other industries, many firms have long embraced the "up or out" approach to career management. Employees who do not progress in expected ways may be managed out of organizations. Integral to this approach is clarity around what the various levels of seniority are, as well as the expectations at each level.

Over time, we have seen these expectations change, with less of a one-size-fits-all approach to career management. More and more firms rely on specialized skills and have begun to seek different career paths for these particular employees. That said, Financial Services firms manage the cost of human capital very aggressively, and knowing how many employees there are, what they do, how much they cost, and how senior they are is integral to the cost management initiatives that matter to this segment.

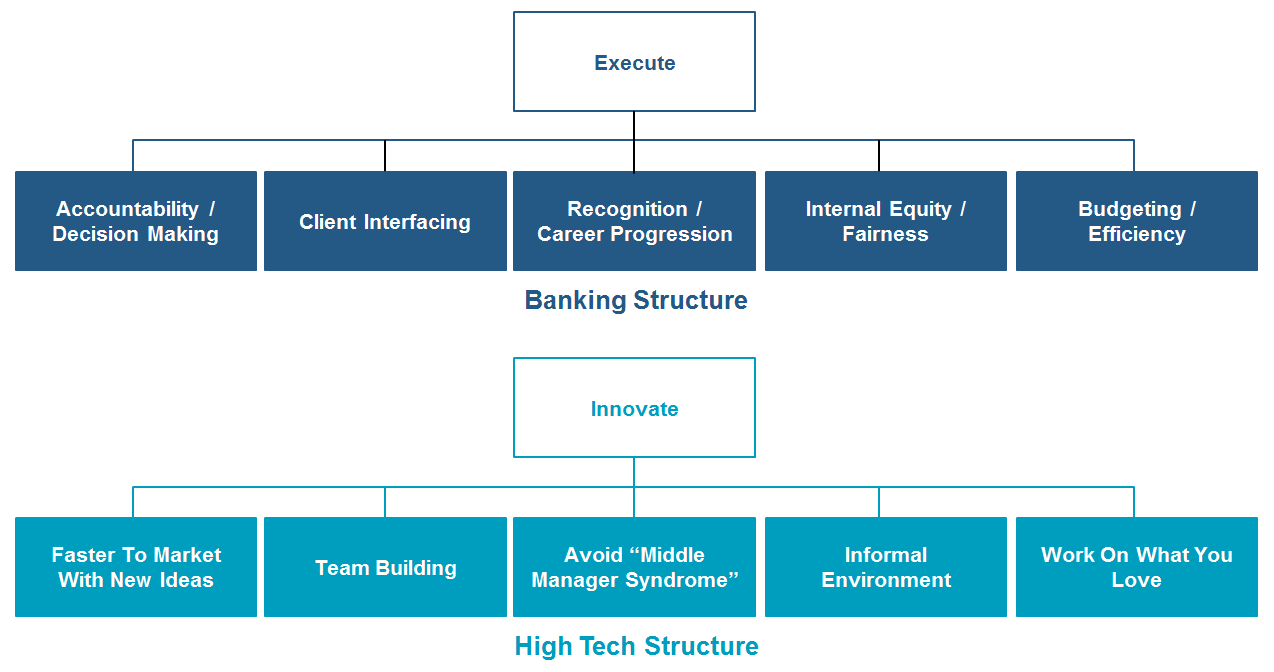

Finally, in many instances these firms are deeply focused on execution and accountability. The need to understand the hierarchy of decision-making around topics like risk management, compliance, and portfolio management, creates an organic need for knowing who is in charge in a way that may not exist as strongly in other sectors.

Consulting

Consulting relies heavily on corporate titles as a tool for recognition and reward. Since this industry has a greater focus on fixed pay versus incentive pay, the primary tool for creating differentiated rewards for employees is to promote more quickly. If corporate titles are not administered comprehensively and with rigor around the process, a firm in this space would quickly lose its ability to reward performance.

Many Consulting firms are partnerships and reaching the level of partner at these firms brings many rewards, both in terms of prestige and economic opportunities. From a cultural perspective, the kind of climate that is created within partnerships—which is heavy on teamwork and career progression—is one that is predicated on the use of corporate titles. Many of these firms see their culture as their greatest asset and their corporate title structure as a fundamental building block of that culture.

Technology Firms

Technology firms are known for having the least formalized structures, as part of their operating model and how they go to market for talent is based on a "flat organization" principle. For these firms, the focus is often on recruiting young talent into informal, non-hierarchical environments. As many of these firms are focused on innovation, a Technology firm wants fast access to new ideas—many of the best ideas may come from relatively inexperienced employees. There is a perception that labeling a new employee as an "analyst" or "non-officer" would discourage management from seriously considering ideas from an "entry level" employee. This mindset could create a barrier to innovation—firms want to source ideas quickly, from whoever generates them regardless of tenure, and have limited bureaucracy in the way of implementing them.

That said, Technology firms are sometimes known to have "shadow titles" or other means of understanding an employee's seniority. These titles may be used for a variety of HR and Reward processes that require corporate title as an input. As modern firms show greater interest in embracing the concept of transparency, it becomes increasingly challenging to rationalize an approach to job architecture that includes the concept of "secret" or "hidden" titles.

Financial Technology

Financial Technology firms' approaches to job architecture in general and corporate titles specifically, will vary based somewhat on what industry the founders of the firm came from. If they cut their teeth at financial services firms, their firm will likely have a structured approach to job titling, whereas if they began on the tech side, titles may be less formal, or not indicative of seniority.

A particular challenge for Fin Tech firms is that they compete for talent with both Financial Services firms and Tech firms. Financial Services employees who have built their careers and resumes over time may be loath to take a position where they are compelled to let go of their tangible career progression—it is a big leap in today's job market to join a firm without titles if you have invested a lot in your career growth.

That said, Fin Tech firms rely heavily on Tech talent as well, and many of these firms want to appear modern and informal—will they alienate candidates who are deliberately steering clear of stodgy Investment Banks if part of the interviewing process is to discuss at what "level" you will join the firm?

Customized Solutions

Like all good human capital solutions, what each firm needs will vary based on their business strategy, their culture, the skills they require and ultimately—what it is they want people to do. Consider the tension between what Financial Services firms need and what Tech firms need—do these differing needs adequately account for the different trends in how they use titles:

When building a corporate title structure some key issues to consider are:

-

How important is industry familiar title in recruiting talent? Will candidates who have thoughtfully built their careers join a firm where there are no titles or the title structure does not support a feeling of career progression?

-

What titles will work well for clients? Will they be able to quickly understand the level of the person with whom they are interacting?

-

How many corporate titles do we ultimately want? How often should a solid performing employee get promoted? How many levels can we make, such that there are meaningful and clear distinctions between each level?

-

Do we expect progression through this level structure based purely on capability, purely on tenure or a blend of the two?

-

Will we allow for promotions based on deepened skill in the same job, or must you move into a new position to advance title?

-

Are there distinct responsibilities or accountabilities that we want to assign at specific levels of development?

-

How does the proposed structure fit and interact with other aspects of the job architecture and reward structure, such as pay grades, performance management, and career pathways?

Conclusion

Within any of these business verticals there may be subtle requirements at a given firm that can run contrary to the typical industry need. We certainly see a number of smaller firms coming of age, and requiring "big firm" solutions in how they manage human capital. Whether that solution includes a single firm-wide corporate title structure, tailored structures per business line, discreet paths for specialists versus generalists, unique accommodations for individual contributors versus people managers, frequent promotions to engage millennials, or a grind it out 'til you make partner approach like in the old days, firms appear to benefit from the structure and clarity that a thoughtful implementation of corporate titles can provide. It's okay to be a little stuffy sometimes.

1The Millennial Myth, Corporate Executive Board (2014)