As we move into the second half of 2017, market conditions have changed, interest rates are climbing, and, with them, a notable shift in mortgage banking from a refinance-driven market to a purchase-driven market. The current purchase market favors the sales style of loan officers, who drive sales through their network and rely less on the marketing provided by their firm. Conversely, the historic refinance volume in the market has created a place for loan officers who drive most of their sales through bank referrals. In a purchase market, these employees will need to adapt in order to continue driving volume.

Current market dynamics pose a challenge for firms that want to remain competitive and grow. While the switch from a bank loan officer to an independent loan officer seems easy enough, there’s a catch. Not only is this particular pool of trained specialists somewhat stagnant, it often fails to be replenished, creating a clear challenge in today’s transforming market environment. Loan officers that can drive self-sourced volume are in high demand, yet a lack of millennial interest results in an ever-shrinking talent pool, where pickings are already slim. The typical loan officer’s average age ranges between 50 and 60 years old. In order to effectively gain a competitive edge moving forward, firms must utilize practices to find the best talent and grow this diminishing pool of skilled professionals to coincide with its increasing demand.

How, then, do firms attract fresh talent and pursue a growth strategy that ensures the right people are on their platform?

Find new external sources of talent

Let’s face it—everyone has been fishing out of the same pond of loan officers for a long time, continually capturing the same individuals with nothing but compensation levels as competitive ammunition. Competing solely on providing the richest commission grid is not a viable long-term strategy. Therefore, It is essential that all other firms find distinct ways to differentiate, enticing new talent to the rapidly diminishing group of loan officers with the necessary skills to thrive in today’s market.

Identify high potential candidates internally

Firms can gain a critical advantage if they are able to identify promising loan officer talent internally. This allows you to build an insulated pipeline of staff that relies on familiar relationships, understanding, and appealing internal opportunities. Such attributes can often counteract the need for higher commissions. In a market where firms are competing with richer and longer guarantee periods, the benefit to sourcing inside talent is significant. The vast number of emerging tools and resources available in a progressively technology-driven industry, makes taking a gamble on an external candidate who is not a perfect fit unnecessary.

Use science to supercharge your current loan officer recruiting strategy

In using a structured approach to study high performers at your firm and develop a selection profile to apply to new hires, we see firms benefit from more predictive hiring results in their recruiting efforts. Additionally, firms can benefit from more structured methods to identify internal candidates, perhaps processors or closers, that can be moved into loan officer roles.

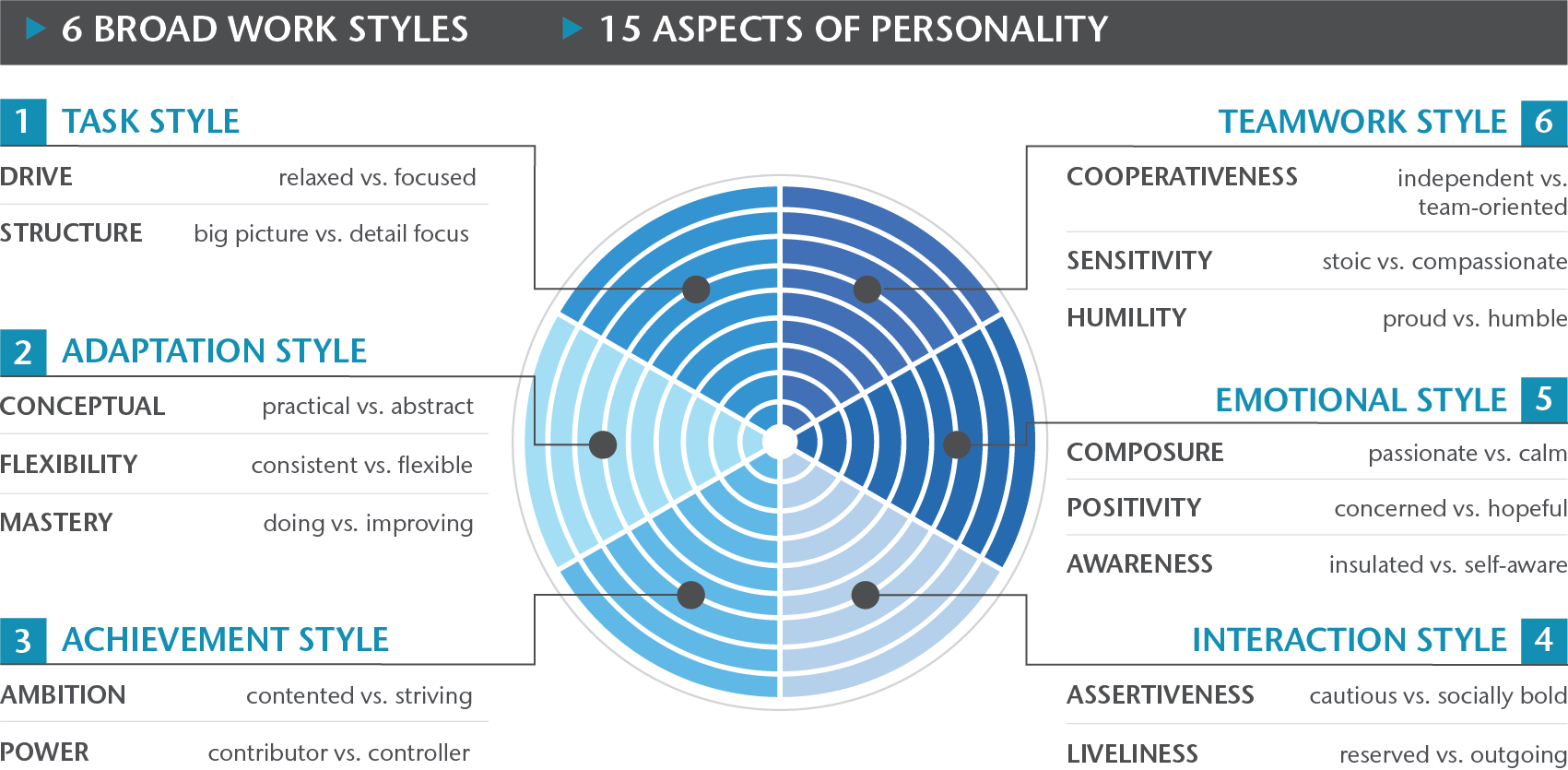

ADEPT-15, our proprietary employee selection and assessment tool, uses proven science to uncover unique aspects of an individual’s personality to help organizations identify the best talent. The ADEPT-15 technology will give your recruiters and managers an advantage over the competition in finding candidates with innate personality characteristics that will lead to success. The power of blending your firm’s internal loan officer knowledge with this market-leading analytical assessment tool creates a long-term competitive advantage in increasingly challenging market conditions.

Positive use of these tactics will help your firm identify loan officer candidates that other firms may have missed, while also generating cost savings. Not only are you fostering a strong channel of unique talent, but you also now offer a rare competitive edge by layering science into what industry professionals know intuitively. This greatly complements the human components of the hiring process—an element which is so critical to the mortgage banking industry. To learn more about how to apply these methods to your talent strategies, contact our team.

Related Articles