While all eyes have been watching the DOL / fiduciary developments, another risk continues to loom over the industry: the dual trends of a rapidly aging FA force and their aging clients.

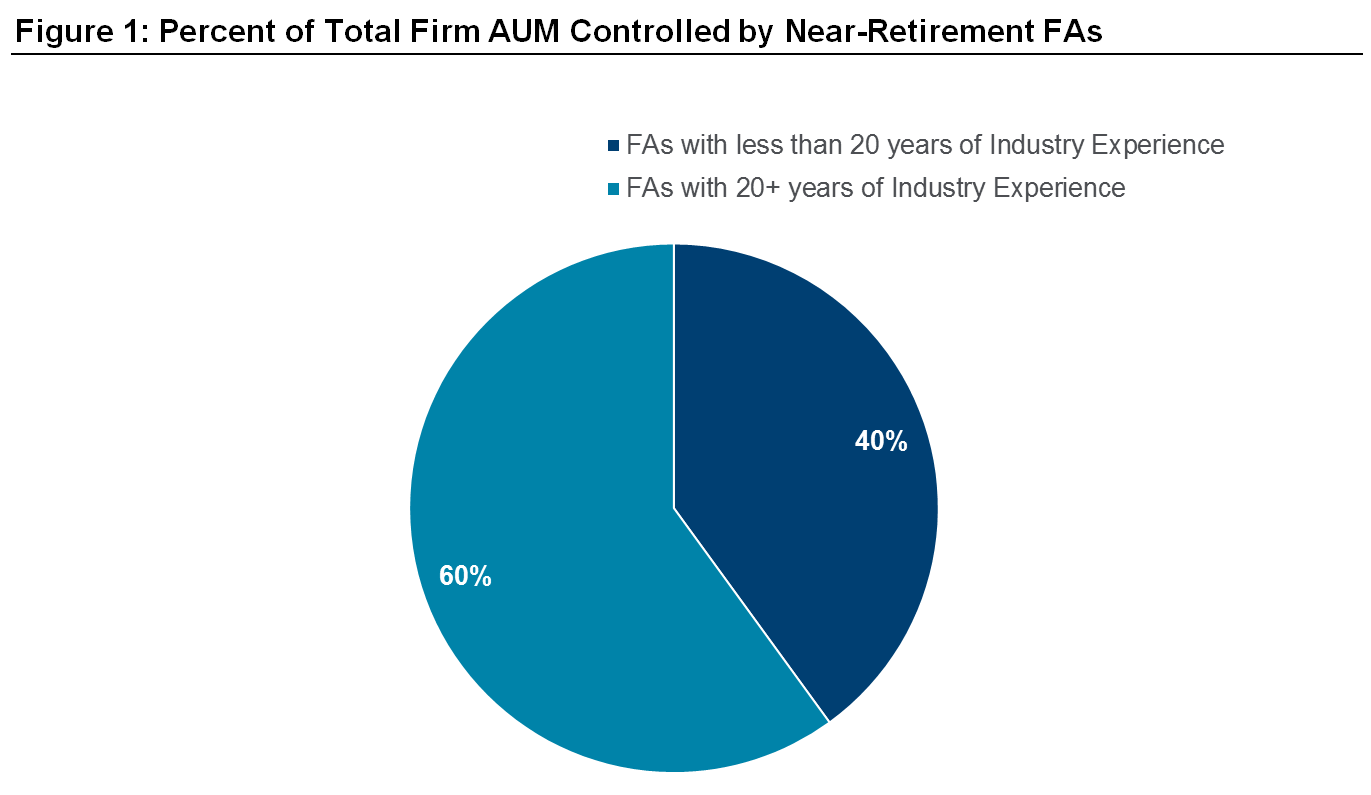

Nearly half of advisors have 20+ years of industry experience and those advisors control a commanding majority of assets under management at their respective firms (see figure 1). That means the majority of assets are controlled by advisors who may be near-retirement—making those assets a flight risk.

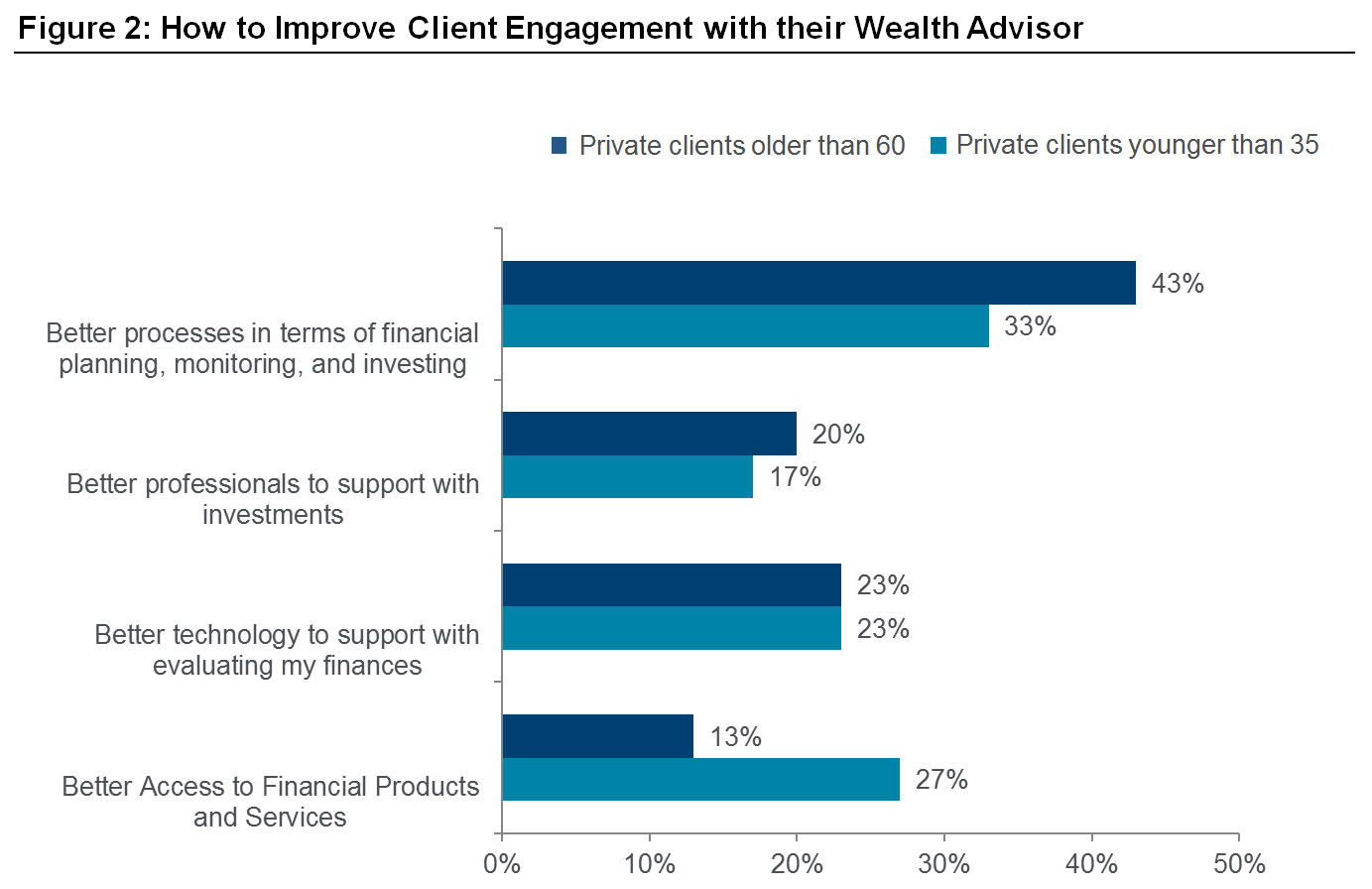

Further threatening asset retention is the aging client population and their transfer of wealth to the next generation of investor, who have very different views on what they want to see from the wealth management industry and from their relationship with a wealth advisor (see figure 2).

As a result, firms need to tackle two parallel problems: transferring retiring FA assets to younger advisors and building an advisor force that is in tune with future generations of clients. These shifts provide an opportunity for firms to maintain control of at-risk assets and develop strong bonds with the next generation of investor through successful succession planning.

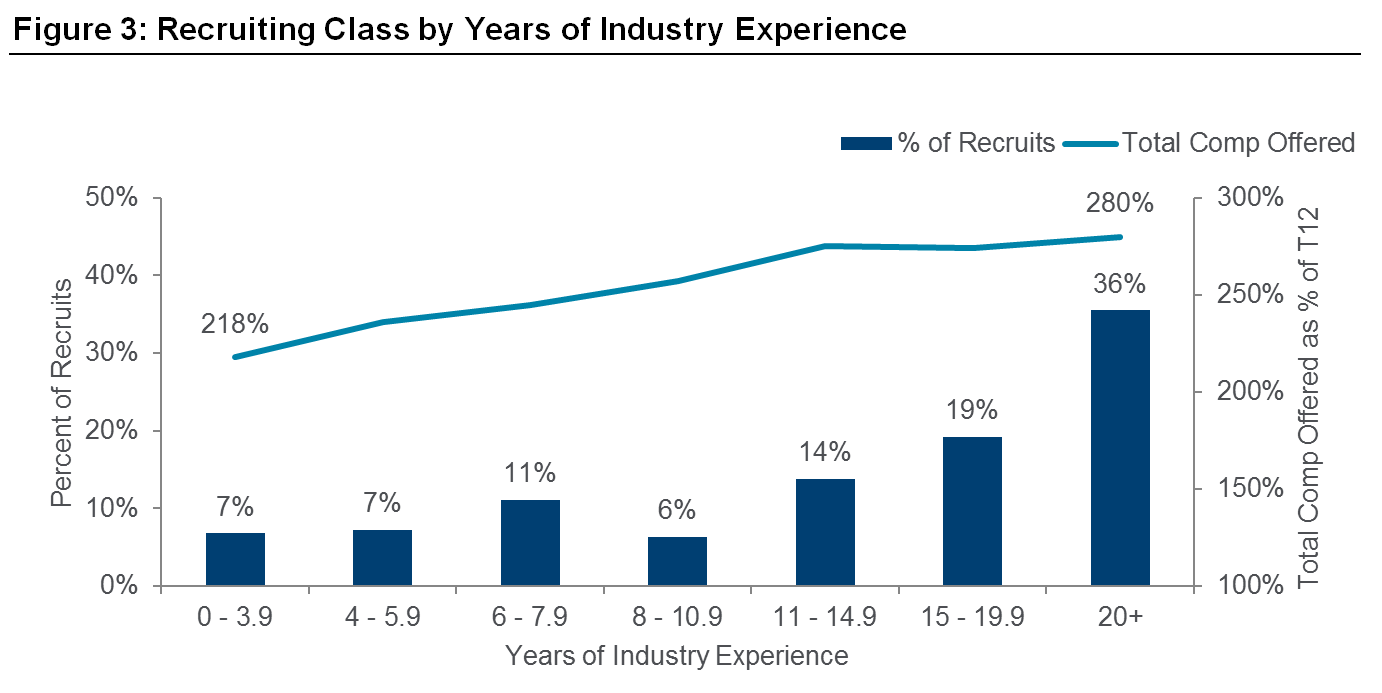

A competitive and flexible succession plan is essential to finding the right talent to advise the next generation of investors. Firms have employed succession planning to keep the assets of retiring FAs in-house, even going so far as recruiting retiring FAs to sunset at their firm. In fact, over a third of recent competitive recruits have had 20+ years of industry experience. But building an advisor force by recruiting older FAs is an expensive proposition (see figure 3), as these FAs demand a compensation premium over their younger peers.

While recruiting older FAs can certainly increase a firm’s share of AUM in the short-term, it exacerbates the issue of such a high asset concentration with these more experienced FAs. Such a strategy executed in isolation represents a missed opportunity to build the next generation of FA. As firms add older FAs and their associated AUM, they should concurrently add new, younger FAs and build trainee programs that improve upon the historical success rate of ~50% attrition by the end of typical 3-year programs.

This raises an important question: how can firms find the right talent to build their succession plan? A good place to start is applying our talent selection tool. Modern people analytics have allowed firms to incorporate science and rigor in their assessment and selection of talent. Aon has applied this proprietary assessment technology with federal law enforcement agencies to help them improve talent selection, and this assessment technology can be customized to assess Financial Advisors. Incorporating comprehensive diagnostics which measure both personality traits and cognitive ability helps firms identify entrepreneurial individuals who have the drive and persistence required for success as an FA, and who are a good overall fit for the role and the firm’s culture. More specific to transition planning, talent selection can help firms on multiple fronts: (1) better match clients to FAs, (2) increase team efficiency, and (3) identify FAs most likely to adapt to regulatory changes.

As talent exits the organization and new clients take the place of old, transferring knowledge and preserving continuity are critical. More than ever, incoming talent needs to have the capabilities to perform at the highest levels, align to the company’s culture and assimilate quickly into a team. Our talent selection tool provides insights into the key performance drivers of talent, ensuring low volatility and high performance in the workforce—so firms have the data they need to build successful succession strategies.

As sweeping changes disrupt the industry, all efforts to retain clients and their assets remain of paramount importance. The right succession planning strategy can help firms retain at-risk assets while developing FAs to serve a new generation of investors and maximize the client experience. In our next piece, Building Blocks for Financial Advisor Success, we will discuss strategies that aim to improve the performance growth curve for advisors at various stages of their career.

Previous articles in this series

Related Articles