Like many other aspects of the financial services industry, the call center as we know it is changing. Technology is disrupting historic practices and generating new, client-centric demands that require shifts in current focus areas and models. As a result, call centers now face a fresh set of challenges surrounding training and development, pay levels, job structure, incentive plan design, career progression, and more, all while competing with the appeal of non-financial services firms.

Yet, the importance of call centers remains, as indicated by high headcounts and the function’s direct contact with consumers—a crucial part of today’s growing service-centric environment. Historic practices and services must evolve for call centers to maintain their relevance in the current industry, where competition and business goals are continuously shifting. Customer engagement and experience are key in today’s professional world. So, how are firms approaching the architecture of their call center roles accordingly? It is essential to re-define the consumer call center as a dominant player in the customer service experience and upgrade your workforce along with it.

In our recent 2017 Call Center Study, we asked organizations to share the greatest challenges that they are facing within their call centers. In response, we identified relevant trends in incentive plans and service models that are occurring across a diverse group of consumer-facing firms.

Recruiting and Retention Remain Top Challenges

As the nature of call center roles continues to change, firms report significant obstacles in retaining and recruiting call center staff. Recruiting for call center roles is heavily based on location rather than industry alone. According to our findings, both banks and non-banks indicated a slight preference towards recruiting from other financial services call centers, yet focusing on local talent markets also remains a priority among the majority of respondents. These considerations present a unique set of challenges as firms decide where to locate their call centers, taking into account cost, availability of talent, and other local businesses. While these challenges are affecting all types of firms, competing with non-financial services firms was interestingly identified as a top challenge only among banks. This is a consistent hurdle for other functions as well, as banks struggle to compete with non-banks culturally.

Beyond compensation, there are a number of other ways financial services firms are tackling this issue. In fact, a key opportunity for differentiation among firm call centers often lies in the non-compensation benefits that are offered. Firms are increasingly focused on improving the quality of their staff through tuition reimbursement and additional training and development. Common benefits, such as wellness programs, flexible work hours, free coffee and other beverages, education reimbursement, and team outings, also contribute greatly to improving culture and employee work-life balance. A highly engaged employee means a high performing employee, and one who is likely to stay with the firm.

In our findings, we additionally observed an increased usage of employee engagement surveys. The majority of firms (77%) conduct internal engagement surveys among their call center employees, which is a significant shift from last year (27%). The criteria used in the engagement surveys includes training, career development, manager effectiveness, company pride, and morale. Engagement scores range from approximately 60% to 90%. We view the utilization of these surveys as an emerging trend across all financial services, especially within call centers, as employee engagement is one of the tools that firms can use to improve employee retention.

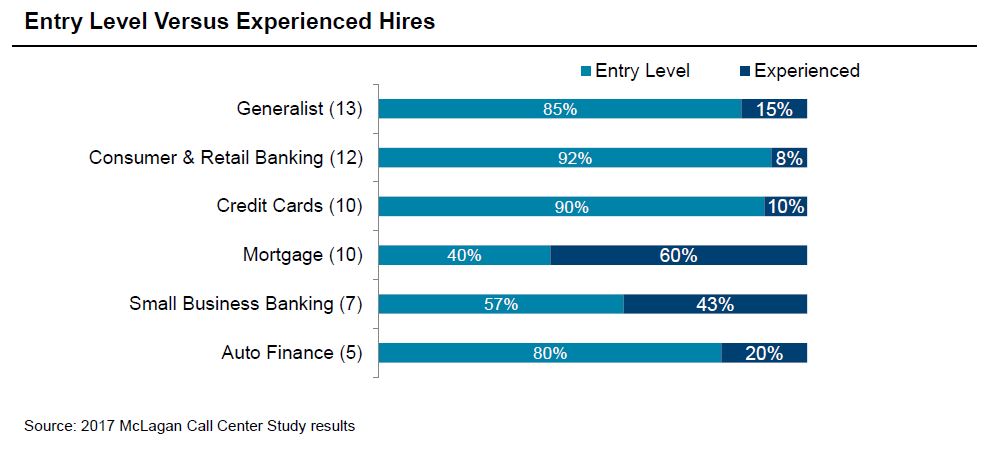

To initially attract this talent, firms use various methods and typically target entry level staff for call center roles, with the exception of mortgage banking and small business banking specialists. The products covered in these areas are usually more complex and require employees with more experience. The chart below shows firms who primarily hire entry level candidates versus those who hire employees with experience.

Are Non-Annual Plans Best for Call Centers?

While past practice dictates that the majority of call center roles are paid on non-annual business-lines or functional plans, there has been a recent shift in ideology that calls this practice into question. Due to regulatory pressure, administrative burden, and consideration of the overall effectiveness of these strategies, several firms, particularly large banks, have taken steps to consolidate call center plans. While this change is most prevalent at management levels, a few firms moved, or are considering moving, call center representatives to non-annual plans as well. In addition to understanding that this change presents many benefits, such as decreased complexity and better alignment with overall firm goals, it is also important to consider possible pitfalls, including market competitiveness, compression issues, and the ability to differentiate pay for performance effectively.

Based on our 2017 study results, incentive plan payouts remain more frequent for staff and less frequent for management. Monthly payouts are still the most common practice for call center representatives spanning almost all functions including customer service, collections, concierge / premier customers, and sales, with the exception of fraud, where timing is split between monthly and annual payouts. For managers, annual payouts are most common and are continuing to gain traction.

How do firms typically determine eligible payouts? Most call center representative plans have gateways whereby employees must meet a minimum performance threshold before they are paid incentives. Fraud is the only function where gateways are not usually part of the plan. Gateways are also less common at supervisor and manager levels, where, according to our findings, firms are split down the middle. It will be interesting to see how these performance gateways are adapted if the firm chooses to change their plan structure. It is also common for firms to have scorecard based incentive plans for their call center representatives across all functions except collections and sales, where commission / widget-based plans are most prominent.

It is interesting to note that there is now an increased number of firms with pure discretionary plans compared to last year. This approach holds no formal structure, allowing the employer to determine a reason for awarding a bonus, such as reaching company and financial goals or exceptional performance. Discretionary plans allow for increased flexibility in rewarding top performers—a crucial component for the success of tomorrow’s workforce. Besides this benefit, why is this approach gaining so much prominence? Discretionary bonuses are typically used for roles that are more complex, where specific duties can change year over year. An increased demand for this plan demonstrates the vast ways in which call centers are evolving, with roles becoming more service based vs. transaction based.

Increased Focus on Quality over Quantity

With the call center evolution comes a rising emphasis on superior quality and providing the optimal customer experience. To support this, financial services firms are focused on simplifying their compensation structures to ensure market competitiveness and alignment with business objectives. The number of overall metrics has been reduced, with quality and customer service metrics now outweighing productivity metrics in incentive plans for many non-sales focused call center representatives.

Our research revealed that the majority of firms determine quality of service using some form of call monitoring to measure the service level of their call center staff. The second most prevalent form of measurement is direct client follow-up using either an online survey or phone call. Overall, we found that most businesses measure customer service at the individual and team or site level.

Use of Shift and Multi-Lingual Premiums

In order for call centers to be successful in servicing customers, firms recognize the importance of having staff available to handle calls outside of normal business hours and in many languages. A number of financial services firms are offering to pay premiums for night and weekend shifts and multi-lingual call center employees to address these needs.

Firms typically calculate premiums as a percentage of salary, while offering an additional flat dollar amount is a less common approach. Several firms noted that they provide a range of premium amounts based on the shift. The steps between differentials range from 2-5%, with the third shift typically paid the highest premium. In addition, over 60% of firms pay premiums for multi-lingual employees, with half of these firms offering an additional 10% of salary. Clearly, providing appropriate rewards to achieve top-notch customer service solutions is top of mind.

What Does this All Mean?

The winds of change are gaining momentum for Call Center reward programs. Regardless of advancements in technology and a clear shift towards self-service models in financial services, the traditional essence of the call center will remain. The evidence is strong—call centers are a pivotal facet of the business for consumer facing firms. However, competition is rising, demands are changing, and business plans and models must follow suit. Call centers, especially in the consumer banking industry, must be re-visited, strategically re-planned, and perhaps even re-defined. The call center role is transforming into groups of highly skilled individuals that truly add value to the business through both customer experience and customer centricity – two essentials in today’s highly competitive business world.

Related Articles