With such a substantial percentage of executive pay delivered through incentive programs, it’s no wonder that incentive plan discussions comprise a significant portion of the compensation committee’s agenda for many banks. However, through our experience of serving as advisors in over 300 compensation committee meetings per year, we are surprised by how little dialogue exists around the specific topic of annual incentive plan performance goal selection and goal setting.

With such a substantial percentage of executive pay delivered through incentive programs, it’s no wonder that incentive plan discussions comprise a significant portion of the compensation committee’s agenda for many banks. However, through our experience of serving as advisors in over 300 compensation committee meetings per year, we are surprised by how little dialogue exists around the specific topic of annual incentive plan performance goal selection and goal setting.

So, what questions should banks be asking themselves when setting executive annual incentive plan goals? We’ve listed five for consideration.

1. What metrics should we use?

Choosing incentive metrics is not always simple. Thankfully, the hardest work has usually already been completed as part of the strategic planning and budgeting process. The measures chosen for an incentive plan should be well understood both internally and externally, while also providing a direct line of sight to the strategic and financial goals articulated as part of this planning. In addition, they should be measures that result in both bank profitability and shareholder value and are consistent with the message that management is communicating to employees, customers, and shareholders.

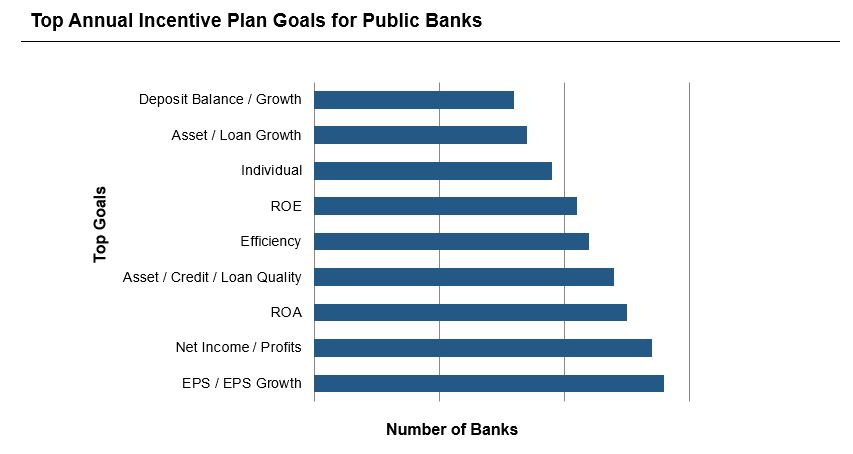

The chart below shows the most prevalent annual incentive metrics in a group of banks compiled for a recent McLagan analysis. While the specific goals will vary based upon overall bank size, profitability, and business model, this provides a solid example of an organization’s typical goals. The most highly weighted goals are usually profit-related and are weighted 40% or more. While asset quality is prevalent, its weighting is generally lower.

Related questions to consider include:

- What are reasons to consider a variation of a standard banking measure (e.g., Return on Tangible Equity instead of regular ROE)?

- How will shareholder advisory firms measure our performance in their quantitative pay-for-performance analyses? Should we try to align?

- What stated company goals and messages are being communicated to the broader employee population?

- If we are planning a stock buy-back, is EPS growth an appropriate measure?

- How are we balancing risk vs. profitability?

2. How should we set target goals and spreads?

As with many aspects of incentive plan design, decisions around target, threshold, and maximum goal levels require a blend of art and science. A common approach for setting target goal levels is to align with the budget. This is logical and justifiable and, for public companies, can be easily explained to shareholders in the proxy.

Setting threshold and maximum goal levels often involves other factors as well, such as an evaluation of past performance, peer comparisons, analyst expectations, the payout leverage in the plan, and an analysis of typical incentive plan goal spreads in the market. For example, as a percentage of target, the range between poor and excellent performance may be much smaller for Efficiency Ratio than it would be for ROE.

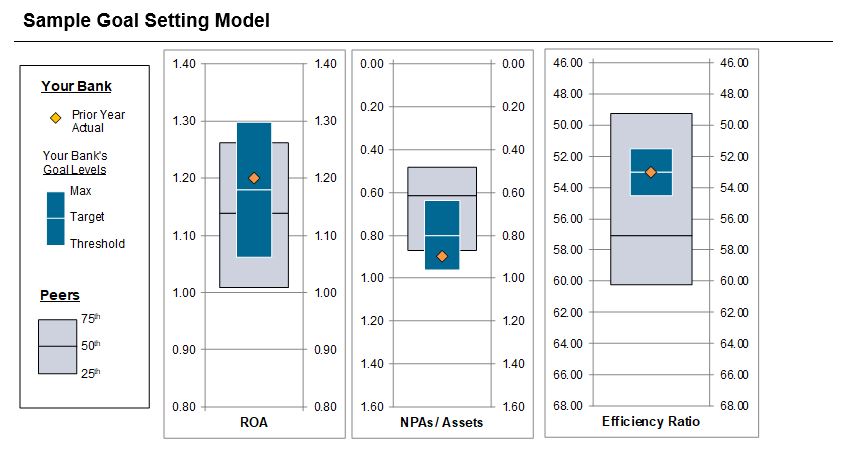

Below is one analysis that allows the company to evaluate some of these factors as goal levels are being developed. The analysis includes pro forma threshold, target, and max goal levels, prior year actual performance, and peer performance for each measure.

An analysis like this encourages committee members and other decision-makers to ask questions like:

- Are we comfortable setting target ROA below last year’s performance? How will shareholders and shareholder advisors react?

- Is it appropriate to provide a maximum payout for NPAs / assets performance that is less favorable than the peer group median?

- Should we increase the spread between threshold and maximum for the Efficiency Ratio?

3. How many metrics should we have?

Banks in the market typically use between three and six metrics in executive annual incentive plans. Having too many metrics can make it less clear to participants where to focus their attention. While a balanced mix of goals is a good design feature, plans with too many also tend to have less variability when it comes to payouts. It is difficult to outperform on every single measure and awards often hover near target year after year, with little opportunity for participants to realize payouts near maximum. At the same time, a plan with only one or two metrics does not likely reflect a balanced measure of company performance.

4. Can our annual cash incentive plan and long-term equity plan use the same goals?

We would generally recommend not using the same or overlapping goals. When short-term and long-term metrics are identical, there is a risk of focusing too much on one aspect of the company’s performance at the detriment of another. In its 2018 Proxy Voting Guidelines, ISS notes that including "a single or common performance metric used for short- and long-term incentives” may motivate excessive risk-taking. Similarly, Glass Lewis's 2018 guidelines note that "reliance on just one metric may focus too much management attention on a single target and is therefore more susceptible to manipulation."

From a design perspective, the annual incentive plan goal structures are typically focused on the annual budget. The long-term incentive (equity) plans focus more on measures that are highly correlated with shareholder value. We clearly recognize that there can be healthy discussions regarding where a goal should be placed on that spectrum.

5. Can we use non-financial goals?

While the majority of goals in bank plans are financial-based, non-financial goals are also used—though often weighted less when calculating awards. For instance, it could be valuable to include goals related to the completion of certain strategic or operational initiatives, internal audit, and regulatory outcomes. These types of metrics can be evaluated as specifically identified and weighted goals, a payout modifier, or as part of a broader discretionary category measured on a qualitative basis.

One challenge resulting from the use of non-financial goals for public companies is the difficulty in externally gauging whether the company applied rigor in its evaluation of results or why the goal itself has relevance. The company’s disclosure should make these points obvious to shareholders.

To sum it up…

Compensation committee members and all those involved in setting and approving pay programs need to approach the topic of goal setting thoughtfully—carefully balancing an increasingly complex list of internal and external factors. The process and the outcomes are improved with proactive analysis and an understanding of market practices, clear communication, and a demonstrated commitment to pay-for-performance.

To gain more insights on mastering your executive compensation goals for your bank’s annual incentive plan, please contact our team.

Related Articles