As financial services firms’ business models continue to evolve, legacy technology will likely be replaced with emerging technologies, resulting in a convergence of the technology and financial services industries. New technology innovation has already done a lot to improve the customer experience, supply data for decision making, and reshape longstanding firm policies and practices. The question is whether financial firms have the talent to support further innovation at the appropriate speed.

Companies are now focused on placing the transformation of their workforce at the center of their strategy and exploring new ways of working through agile methodology, redesigning their organizational structures, evaluating their entire employee value proposition to improve engagement, and making strategic investments in new skills and technology to support this transformation. To compete and keep up with emerging technology firms and the Silicon Valley approach to attracting and retaining key employees, the financial industry must acknowledge that the broader ecosystem of rewarding digital talent is changing and transform its value proposition with it.

Staying ahead of the curve

We’ve already seen firms start to prepare for these business trends with training, upskilling their talent, recruiting new talent, transforming their cultures, and investing in HR analytics. This is the time for HR to shine, using data analytics to act more as business partners in their role and support the transformation of their firms’ workforces.

We expect to see a continued increase in the hiring and nurturing of tech-enabled employees, including providing management and development programs to help transition existing employees into the digital environment. It is imperative to focus on critical roles and skills in the business and find tech-enabled people to fill these positions. Firms that don’t will be at risk.

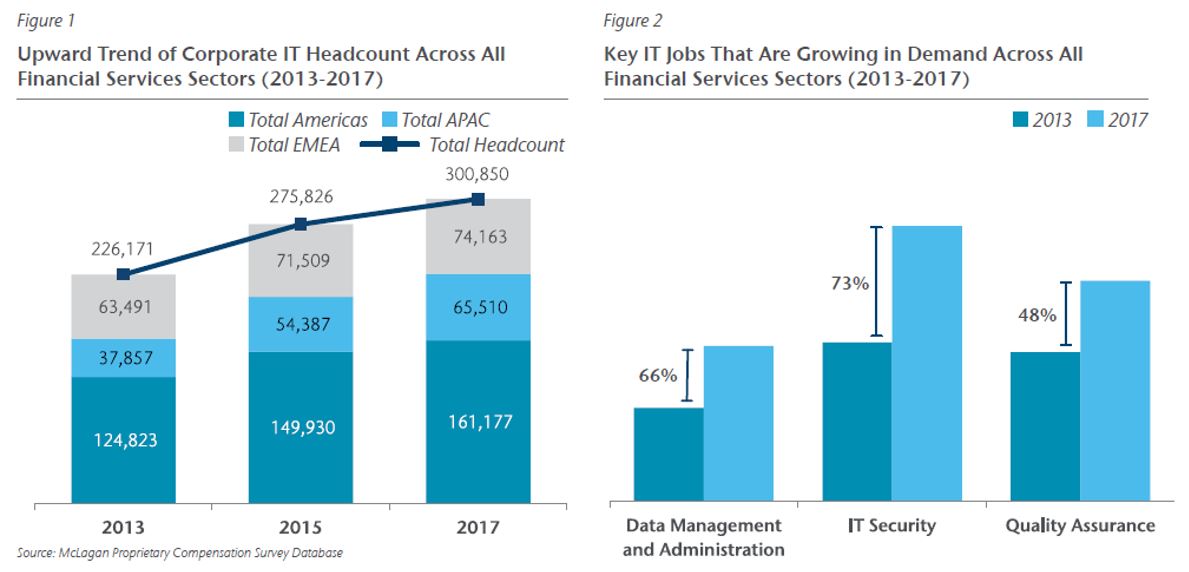

Figures 1 and 2 show the increasing number of technology related jobs we are seeing in financial services firms across regions and highlight some of the hot information technology (IT) jobs that are emerging in response to digitization.

The emergence of Financial Technology (FinTech)

It can be argued that most financial firms are, in a sense, FinTech firms given the incorporation of technology in virtually every job and all aspects of the industry.

Our view defines FinTech as organizations that provide financial solutions, platforms, and services to other financial services firms and industries. Although not necessarily a new term in the marketplace, FinTech now comes in many different flavors and includes a broad range of both emerging and mature disruptive technologies, including verticals such as electronic trading, analytics, risk management, portfolio optimization, research and market data, alternative financing, and payment solutions.

As FinTech firms continue to grow their market share and head count, they are often more focused on growth than cost, creating potential implications for traditional financial services firms, which have historically been slow to invest and adapt. Over the past three years, the total global investment in the FinTech sector has reached $122 billion.1 With looser oversight and a more decentralized system, this sector experiences far less regulation, paving a path for rapid expansion. Firms are also developing all over the world, with heightened prominence and growth in Africa and Asia, particularly in India and Japan. In Asia, regulators are actively supporting FinTech because it helps promote financial inclusion, making the financial services industry more efficient and customer-friendly. In fact, the unbanked and underbanked in emerging markets are being targeted directly through mobile technology. For these individuals, their first interaction with a bank is likely to be digital using e-payments and e-commerce platforms such as Paytm in India and Alipay in China, which are largely enabled through FinTech.

Rather than viewing FinTech as competition, traditional financial services firms are starting to leverage the tools and opportunities this sector offers. We expect to continue to see firms set up intellectual incubator platforms, which provide connections between FinTech startups and established financial firms to help develop forward-looking ideas, while delivering real capital for firms to invest and adapt with the shifting landscape. Financial firms are also identifying and evaluating FinTech with the best value propositions for lucrative partnerships. In return, FinTech firms gain support and access to large client groups and expert knowledge.

What does this mean for our people in financial services?

1. People will continue to play a key part in the success of financial services firms.

It will be more about the way technology and people form an alliance to work together proficiently. 25% of the workforce holds jobs where a high percentage of tasks could be automated, resulting in organizational re-structures and headcount reduction.2 Businesses are constantly evolving and using new product development to improve interaction with self-service models, which causes firms to require new behaviors involving strategic thinking, driving change, and cross functionality. It isn’t necessarily about replacing people. It is about hiring and training people with new skillsets and can help financial firms embrace an entrepreneurial mindset where needed.

For example, fifteen years ago retail bank tellers only did bookkeeping and cash transactions, but now that these tasks are automated, the teller’s role has shifted to keying in information, scanning a code, or assisting and educating customers with their online and mobile transactions. In the wealth management space, sales and trading jobs will decline as platforms continue to take over, and robo-advisors will eventually dominate (Figure 3). All of these changes present the opportunity for people to grow their skillsets and assist in the development of platforms. However, most firms are still in the technology investment stage, hence, they still need people—just new kinds of people with adaptive mindsets, skills, and goals.

2. While there has been a decline in some roles, there are many new jobs and departments that are developing as a result of technology disruption.

This is true particularly in the areas of compliance, cyber security, technology, and risk. According to our Cyber Security Pulse Study, 95% of financial services firms planned to increase their cybersecurity headcounts in 2017 and firms are paying a premium to fulfill such roles. In fact, our analysis reveals that digital transformation roles in financial services and technology sectors have experienced an 8% pay increase year-over-year. As the number of digital positions continues to rise, so does the need for financial services firms to readjust their longstanding compensation policies. Determining pay mix and strategies entails many considerations, including which roles are most important, how many are needed, what jobs will be hot for longer, and how to attract and differentiate top performers.

3. Recognition methods are changing.

To successfully master this tech-inspired business remodel, firms must properly acknowledge their most digitally-skilled professionals for their contribution to the firm. Interestingly, Radford’s Talent Pulse Study found that 72% of technology companies say monetary and non-monetary forms of recognition are equally effective. Following a similar direction, financial services firms emphasize methods that reach beyond pay, offering appropriate recognition tools and innovative reward practices that provide opportunities for further engagement—a key component for attracting and retaining key employees.

In conclusion

Clearly, people are still an important part of the equation, particularly those who are able to interact with the increasingly digital world. Support roles may move to low cost centers, while creative, collaborative roles that engage with forward looking initiatives will be in the highest expense centers and paid the most. Machines will not take over—employment naturally changes over time.

To learn more about tech convergence in financial services firms, please contact our team or download a complimentary copy of the McLagan Perspectives Report. You can also visit our website here for available tech convergence services and solutions to help your firm adapt and prepare for transformation.

1 Global FinTech funding tops U.S.$31B for 2017 - fueled by U.S.$8.7B in Q4: KPMG’s Pulse of FinTech report: February 2018

2 Organization for Economic Co-operation and Development (OECD): Future of Work and Skills

Related Articles