In today’s fiercely competitive market, credit unions are increasingly competing with the broader financial services market for top talent. This results in the need for new compensation plan design for credit union executives and key leaders. We’re beginning to see a rise in prevalence of long-term incentive plans (LTIPs) driven by three main factors:

- Market trend towards performance-based compensation

- Risk best practices

- Tax law changes

What is a long-term incentive?

At credit unions, a long-term incentive is typically designed as a cash incentive earned based on the organization’s performance over 3 to 5 years. For example, an LTIP grant that is made to a group of executives at the beginning of 2018 would vest based on strategic performance metrics over the three year period from 2018 to 2020. The long-term incentive award vests according to the level of goal achievement and is paid out in early 2021. Normally, these long-term plans are used in addition to existing annual cash incentives, which are already in place at most credit unions.

Performance-based compensation

The market practice for compensation across all industries is shifting away from exclusively executive benefits which are solely time-based, favoring performance-based compensation like LTI grants. Credit unions typically set 3 to 5 year strategic plans and long-term incentives effectively tie executive pay to execution of long-term strategy.

Long-term incentives and risk mitigation

Well-designed incentive plans mitigate risk by balancing annual and long-term performance metrics within their plans, i.e., 3 years or more for LTIPs. Including long-term metrics in incentive plans better aligns executive pay with the mission of the credit union and the long-term interests of members, while also ensuring that executives have a balanced perspective of risk and reward. This ultimately helps the board communicate to members that sound incentive, risk, and corporate governance practices are in place.

New excise tax

The U.S. Tax Cuts and Jobs Act, which was signed into law in December of 2017, introduced an excise tax on executive compensation at credit unions. For tax years beginning after Dec. 31, 2017, tax-exempt employers, including credit unions, must pay a 21% excise tax on compensation above $1 million for employees who were one of the five highest paid employees at any time.

The new tax rule includes 457(f) payouts in the $1 million test. For credit unions that use 457(f) plans, this means a higher probability of going over the $1 million test in a year where a 457(f) payout vests. With more frequent, smaller vesting amounts than the typical 457(f) plan, an LTIP structure may help your credit union avoid the excise tax.

Current market practice

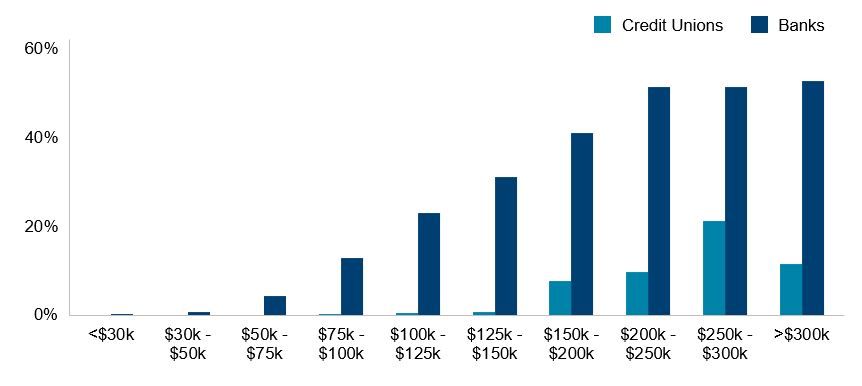

According to the latest data from McLagan’s Regional & Community Banking Compensation Survey, just over 50% of banks under $10 billion in assets have a current LTIP in place for their top executives. Banks tend to have a higher prevalence of long-term incentives compared to credit unions for three reasons:

- Expectations from shareholders and corporate governance firms for performance-based pay

- Bank regulatory guidance on sound incentive compensation practices

- The availability of equity as a convenient long-term incentive vehicle

% of Employees Receiving Long-term Incentives

What’s next?

Leading edge credit unions are considering how long-term incentives can position their organizations for the future, especially in a tight labor market for executive talent. Depending on the size of your credit union, long-term incentives can be used outside of your top executive group. In order to stay competitive with the broader financial services and general industry market, be sure to consider your key leaders below the executive group as well.

If you would like more information or are interested in scheduling a board education session on compensation practices, please contact our team.

Related Articles