Questions have been raised on executive and directors’ pay in Southeast Asia and across the world, with Standard Chartered being in the news most recently in July 2019, after more than a third of shareholders voted against its directors’ remuneration policy and questioned the bank’s executive pension pay levels. A month prior to that, NED remuneration for a leading conglomerate in Malaysia received a negative vote by its shareholders, due to reservations against the remuneration proposed, especially for the chairman of the board, who had allegedly committed a disproportionate amount of board time to turnaround the ailing company.

Such cases where shareholders challenge executive and non-executive directors’ remuneration, pose two fundamental issues for us to think about:

- How do we align directors’ remuneration to shareholder interests?

- How do we recognize directors’ contribution to the organisation during a period of change or transformation, and are all directors to be treated equal in their contributions?

Alignment of NED remuneration

While a significant portion of the total compensation for most executives comprise equity, the cash vs. equity conundrum is a trickier one to solve in the case of NEDs. In Singapore, it’s a split verdict—half of all companies with market capitalisations of more than US$10 billion award equity to directors, while the other half do not. These shares usually have some holding requirements (including post-retirement) to create alignment with shareholders, especially in terms of time horizon of risk.

Some decisions that the board makes (e.g. entering into M&As) may have a downstream impact that is reflected in share prices at a later stage. Ensuring directors are only able to access their shares after a certain period of time allows for shared responsibility of such decisions.

As quality of disclosures is becoming more robust across jurisdictions, shareholders are also becoming increasingly aware and careful about the perquisites and benefits offered to NEDs. Globally, there is a move towards providing fees to directors and only basic benefits, including transport-related benefits such as a car and driver. In certain cases, and jurisdictions, benefits like housing, club membership, and insurance are also prevalent. These, and a few other retirement-related gifts, do not cross the line of benefits that are typically disclosed and hence, are not subject to scrutiny.

However, regulators are becoming increasingly prescriptive about disclosures of benefits. This creates the need to revisit provided benefits to ensure that they are not excessive, but rather competitive enough to attract the right calibre of directors.

Recognition for contribution during periods of change

There are a few typical scenarios that place calls on NED time, which are over and above the regular cadence of meetings. These could be corporate transactions, such as an acquisition, period of transformation in the organisation, or a transitionary period for the CEO. Such cases also may require dedicating time to discharge duties in the form of additional meetings or forming special committees.

Approaches to remunerate directors for the ‘active’ role they could be playing in special scenarios include:

- Benchmark to existing committees: The additional remuneration can be calculated based on existing committees and fees, as well as the time and effort required to discharge the additional responsibilities. This approach values additional time spent during change with the same lens as time spent in normal course.

- Opportunity cost of time: In today’s digital age where work can happen from anywhere, on any platform, and at any time, remunerating NEDs for the opportunity cost of their time may no longer be a far-fetched idea. This is particularly true in scenarios where special skill sets of NEDs must be called upon. Rather than using additional ad hoc hiring of talent, boards can benchmark compensation for similar jobs / skills in the market and adjust the total quantum for additional time spent.

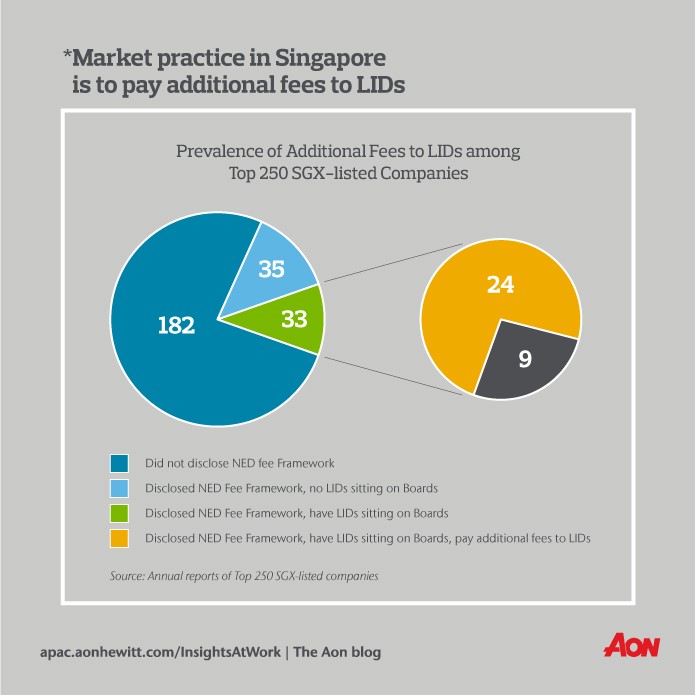

Remunerating directors for special skill sets or experience can have a positive impact on attraction and retention of the best-fit directors for an organisation, especially in times of change and transformation. For example, most financial services firms are currently adopting new business models, policies, and practices that embrace digital transformation, while also adhering to the strict regulation associated with the industry. Building capabilities that help firms lead the way in this forward-looking environment is key. Rather than this differentiated remuneration being a one-off event, firms are appointing Lead Independent Directors (LIDs), who are remunerated differently by way of additional fees. In fact, an analysis of public disclosures on NED fee frameworks shows that 73% of companies that have LIDs on their boards adopt this practice*.

Ultimately, NED remuneration should not only be robust enough to attract the right calibre of directors who can steer the business through transformation, but also aligned to shareholder interests. As shareholder activism and regulatory guidelines drive more disclosures on remuneration, organisations will need to be clearer and transparent on their NED remuneration strategy and structure, as well as its impact on overall cost of governance. External and internal context will play a significant role in defining these.

This is the second article of a two-part series. Please click here to read the first article on compensating non-executive directors for skills, experience, and time.

To learn more about executive compensation and governance in Southeast Asia and other regions across the globe, please contact our team. You can also read a version of this article and explore other regional Asia topics and content by visiting Aon’s Insights at Work blog here.

Related Articles