Financial incentives are a crucial piece of the puzzle when it comes to engaging and motivating employees, encouraging certain behaviors, and aligning employees’ personal goals with your business's mission.

In the last few years, the wealth management industry’s approach to front office compensation has undergone a visible shift from a narrow focus on financial performance to including qualitative aspects of what it means to be an exemplary advisor. This shift is driven by myriad factors—from the changing regulatory landscape, which includes greater focus on compliance and client outcomes, to evolving advisor demographics and changing customer demands.

McLagan recently surveyed 18 UK wealth firms on their short-term and long-term incentive plans to better understand this evolution. Given that the industry is yet to see any dramatic improvements in performance, it’s important to determine how effective these changes are and what firms should be doing differently.

Taking a balanced approach

Formulaic commission-based schemes are popular with revenue-generating teams. They provide clarity in an otherwise complex world and are thus effective at aligning employee motivations and behavior to achievement of specific financial targets. However, poorly calibrated and unrealistic goals only encourage advisors to cut corners in a bid to achieve performance targets and associated bonus pay. It is therefore critical for financial and outcome metrics to be based on accurate data.

Consequently, wealth managers are realizing that incentive plans must reflect more than just shareholders’ needs to include clients, regulators, and even colleagues. This has led to a shift to use a broader set of metrics, often in a balanced scorecard approach, especially for larger wealth firms.

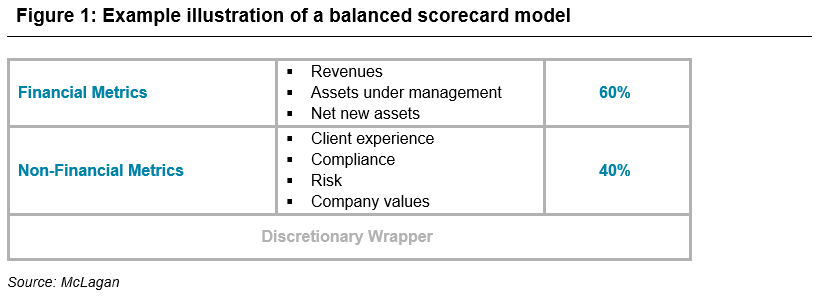

Balanced scorecards include a combination of financial and qualitative metrics. These are assigned different weightings based on their value and importance to the firm (Figure 1). A balanced scorecard retains some formulaic elements—such as revenues, net new assets, and other financial metrics, as well as linking non-financial metrics like compliance, company values, and client experience (CX). Often, the overall scheme is wrapped, which allows full discretion over the final amount paid.

In the U.S., for example, to make frontline staff efficient and deliver a higher level of advice to clients, Morgan Stanley is investing heavily in new technology. This includes tax optimization software, a goals-based financial planning platform, an internal recommendation engine to guide advisors’ decisions, as well as BlackRock’s Aladdin, an investment-risk analysis tool. To encourage faster adoption of these tools, the firm announced that from Spring 2019, it will be linking its advisor compensation strategy to each individual’s propensity to use these tools.

The new incentive plan allows advisors to earn up to 3 percentage points more. Advisors to small accounts will earn 1 percent more if those clients receive a goals-based plan with ongoing monitoring via one of the new tech platforms. If those accounts don’t receive the goals-based plan, compensation to the advisor will be reduced by 0.25 percent. Morgan Stanley is also nearly doubling the pay out to advisors who use its loan platform, giving an additional 15 basis points on the average monthly cash balance funds for clients using the Cash Management program.

What are the risks and challenges?

While technology platform usage is consistent with a focus on client outcomes, it is not without its pitfalls. Using a financial planning platform, for example, can become a tick-box exercise for advisors wanting to hit their target and result in poorer planning for clients.

Introducing client satisfaction metrics into incentive plans is even more fraught with risks. While it is beneficial to signal to advisors the importance of balancing financial results with client outcomes, including a client satisfaction metric can similarly lead to unintended consequences.

For example, it can result in advisors spending too long on clients with smaller accounts, providing little opportunity to elevate satisfaction scores and pay, and reducing productivity. It can also encourage advisors to press clients for positive feedback scores, undermining the CX process.

Even the process of getting robust enough advisor level data to base pay decisions on can be operationally challenging. A broad client satisfaction metric provides advisors with little actionable feedback, unless it is supplemented with:

i) Reliable data on how client satisfaction is correlated with share of wallet and;

ii) Insight on which specific CX moments are most critical to get right so clients bring more assets to the firm.

Striking the right balance

McLagan analytics has found that certain components of client experience have a disproportionate impact on share of wallet and the critical client experience moments are where firms and advisors should focus. Understanding the relationship between these moments, advisor performance, and remuneration can help firms improve growth and client satisfaction at the same time.

So, while designing a well-functioning incentive scheme remains an immensely challenging process, striking the right balance between multiple quantitative and qualitative metrics will ensure firms remain competitive, create desired outcomes, and are in line with regulatory principles. As is often the case, the balance is tricky to achieve and will depend on a host of business requirements, including the firm’s unique culture, operating model, and specific organizational functions.

To learn more about shifting incentive plans and finding the right balance for your wealth management firm, please contact our team.

Related Articles