Technology investments are happening at a record pace across financial services and property-casualty insurance companies are no exception. Strong financial conditions in 2018 have paved the way for an increased focus on optimizing the digital experience, which directly impacts the customer experience—a driving strategy for success in the insurance industry. When it comes to embracing change, there should be no letting off the pedal. Business leaders must continually evolve longstanding practices, using new advances in technology to fuel their journey forward.

This article takes a closer look at the financial conditions of 2018, key trends that are impacting and shaping the future of the property-casualty insurance sector, and what to expect for the year ahead.

In general, the perspective of most property-casualty insurance companies has improved throughout the year due to increases in their ability to grow revenue and profit. The business environment is rapidly changing, and strong financial conditions have allowed companies to invest in new operating models and core business operations, such as acquiring new agents, expanding their geographic footprint, and adding to the product portfolio. Leaders are asking themselves—how can we continue accelerating growth, embracing change, and digitizing our business, while also reducing emerging risks?

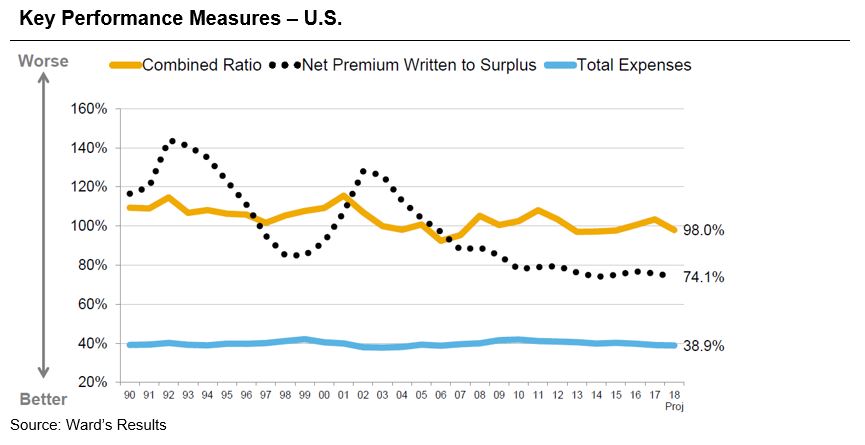

Just as in 2017, declining investment returns keeps the focus on underwriting results and profitability for the foreseeable future. Premium growth over the last four quarters averaged 5.7%, driven by steady personal lines and improved growth in commercial lines. Q3 2018 showed a slight decline in growth rates for personal lines, however, overall, the industry is still coming off relatively high premium growth, which will help carriers invest in technology and innovation going forward.

The property-casualty industry has also achieved modest decreases in direct loss ratio across most business lines, with the overall loss ratio showing just over a 7% decrease. This certainly adds to the positive outlook across the insurance sector.

Projections for key performance measures in the U.S. are based on the first three quarter trends and Q4 projections, and do not anticipate reserve changes by companies. Expenses include underwriting, loss adjusting, and investment expenses.

It is clear that many aspects of the property-casualty industry are clicking together nicely, leaving the insurance sector, as a whole, with strong profitability and operating results at the conclusion of 2018.

The value of human capital

Today’s on-demand, technology-infused economy requires proficiency in new areas of the business. Company needs are constantly evolving to meet new customer expectations and maintain the innovative tools and services that are pivotal for success.

Developing a workforce of the future

Companies are increasingly focused on future-proofing their workforce, especially in an industry where a large number of employees are nearing retirement. According to our 2018 HR and Benefits Practices Study, 65% of employees are over the age of 40 and 11.5% of employees are over the age of 60. Overall employee turnover was up from 10% in 2015 to 11.9% in 2017, due in part to an aging workforce that is retiring and a competitive labor market that affords more opportunities outside of the insurance industry. Involuntary turnover was also up 1.5 points compared to 10 years ago, demonstrating the industry’s quest to weed out poor performers in an increasingly competitive environment. Voluntary turnover is on the rise as well, with retirement accounting for a larger percentage of turnover for many companies. Insurance organizations are therefore trying to attract young talent, while also developing certain skill sets in areas like cognitive flexibility, critical thinking, and complex problem solving coupled with strong technical knowledge. This is driving demand and premium pay for roles in business planning and intelligence, data and analytics, and engineering, which includes cybersecurity and software development.

Therefore, it should come as no surprise that succession planning was the second most popular answer when carriers were asked about their top 3 current concerns for human resources. Yet, only 6% of companies strongly agree that they have solid succession plans in place, which begs the question—are companies investing appropriately in training programs and development of staff? Our studies found that large firms have more employee training investment than small to mid-sized companies, but overall, the average company only spent approximately $1,112 per employee on training in 2017.

People are still important

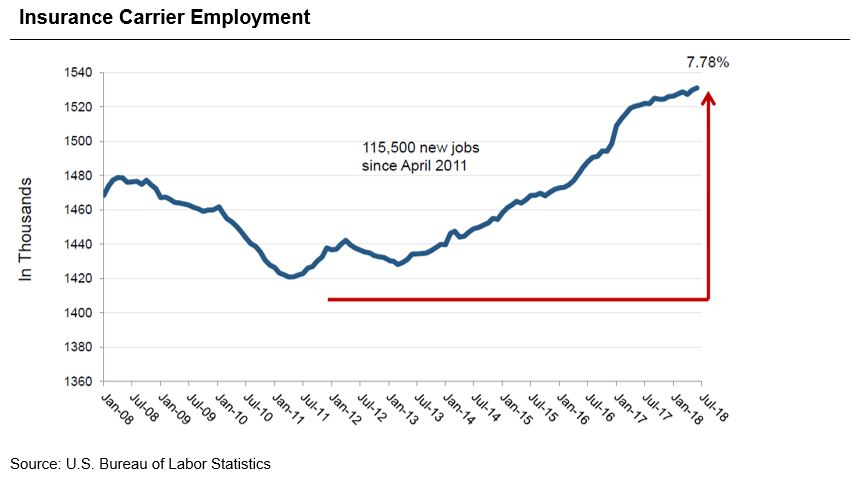

Despite improvements in technology, there will always be a need for people in the insurance industry. In fact, the outlook for most organizations is positive, with insurance companies expected to grow revenue, as well as their staff numbers in 2019. However, in a market with historically low unemployment rates (3.9% across the country and 1% for insurance companies), it becomes difficult for businesses to find and recruit specific talent for the new jobs that are emerging in this sector, as seen in the figure below. Therefore, companies will continue to invest in improving their workforce despite increasing digitization and automation.

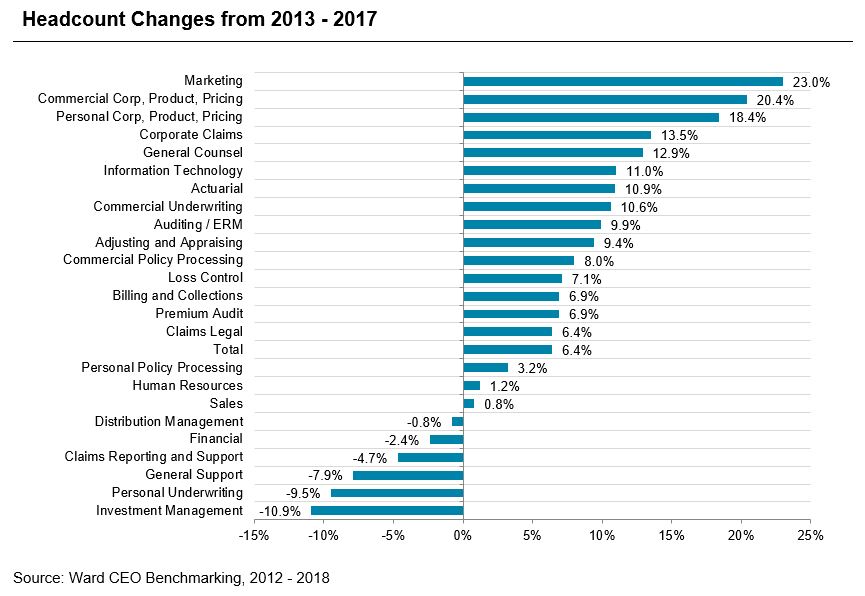

Headcount movement in the insurance industry is constantly shifting with current and future demands. Interestingly, the number one growth area, in terms of a percentage increase in staff from 2013 to 2017, was seen in the marketing function—specifically, customer engagement and digital strategies. Headcount changes related to company positions in technology were lower down on the list, but it is important to consider the use of contactors. If combined with these numbers, total IT positions would have seen the most substantial headcount changes, growing nearly 30%.

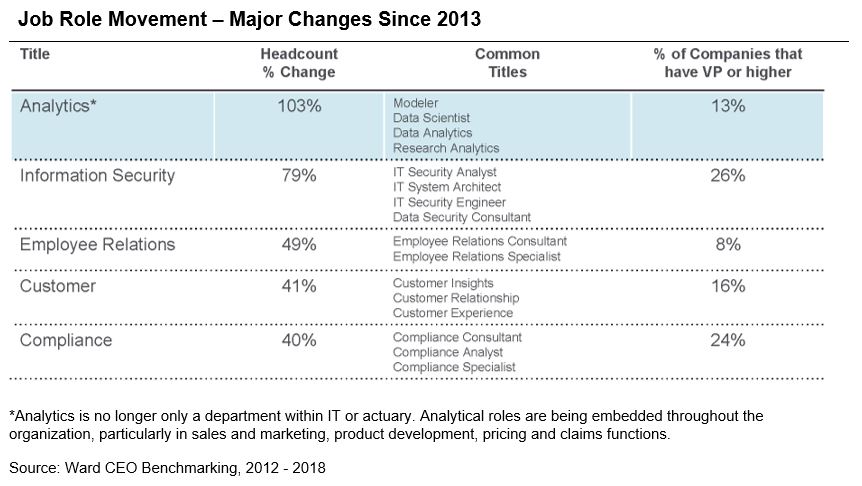

As demonstrated in the figure below, job roles related to analytics show the highest growth. Common titles include modeler, data scientist, data analytics, and research analytics. Analytics is no longer a department only within IT or actuary. Analytical roles are being embedded throughout the organization, particularly in sales and marketing, product development, pricing, and claims functions. If the industry follows through on its plans, we expect to see a 0.47% increase in industry employment during the next 12 months for the P&C sector, as it continues to create new jobs.

The recruiting challenge

For many insurance companies, recruiting difficulty continues across functions, however, roles in actuarial and analytics were slightly easier to fill compared to 2017. This may indicate that more people with versatile skills from outside the industry are applying their capabilities to insurance. Still, according to the Ward HR and Employee Benefits Practices Study, on average, it took 49 days to fill an open non-exempt position and 97 days to fill the average executive position. The insurance sector has also experienced a slight decline in HR headcount. As a result, the pressure remains for HR staff, as it is difficult to address business needs in an environment where they are also pressed to recruit and train employees.

Moving beyond budgeting

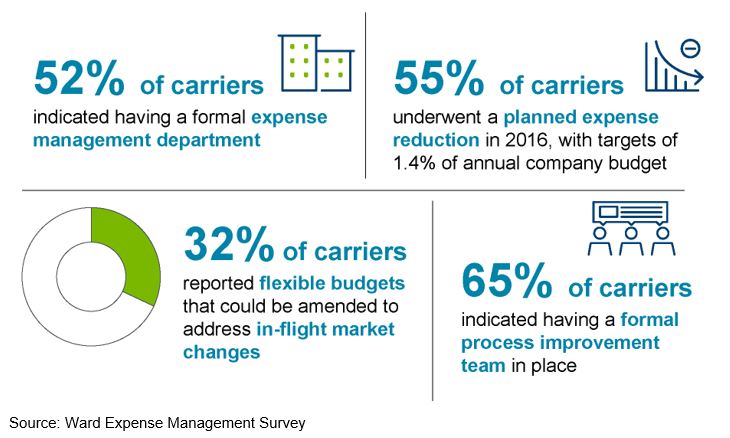

Are insurance companies more productive now than they were five years ago? The expense ratio is lower and the industry is experiencing an overall positive expense trend relative to total premiums written. However, carriers are still focused on operational efficiency and getting more tactical in their approach to expense management, no longer decreeing across the board cuts when an expense reduction initiative is needed.

According to our findings, the number one area of expense growth (relative to prior year expenses) is billing and collections, which increased by 35% between 2013 and 2017. This can mostly be attributed to the use of credit card fees and adoption of electronic payment processing. Other areas that outpaced premium growth include investment management, product and pricing, corporate claims functions, information technology, and commercial underwriting.

Embracing the digital world

As technology disruption continues to take hold, we expect to see the insurance industry keep investing its dollars in digital advancement and solutions. According to our 2018 Business Environment Study, 80% of companies indicated an increase in IT spending for 2018 and 36% reported a significant increase of greater than 15%. This percentage of companies increasing budgets was similar in 2017, where 80% of companies reported moderate or significant increases from 2016, but more companies reported an increase of 15% or more in 2018 (36% compared to 29% in 2017). However, insurance companies are traditionally slower to change and adapt, so maintaining an agile structure is crucial. Companies can also build for the future by integrating digital operating models with existing physical networks, mastering big data, managing security and privacy data, and of course, keeping pace with new technology and trends.

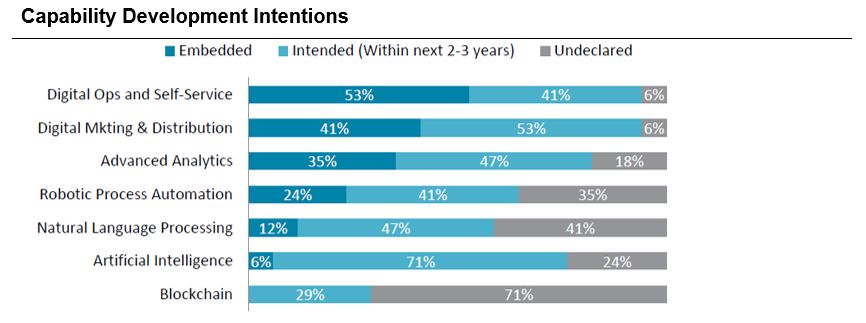

So, where is the focus for digital innovation? The top priorities that organizations are embracing fall mainly into two categories: customer-facing initiatives that improve awareness and accessibility for both existing policyholders and digital prospects and decision-oriented initiatives that offer faster, more effective pricing and operational efficiencies for claims actions and policyholder services. The three most prevalent focus areas appear to be advanced analytics, digital operations and self-service, and digital marketing and distribution. Lowest on the list is blockchain, which many companies are still struggling to integrate into the insurance business. The figure below depicts firms that already have these technology-focused skills embedded throughout their organization, those that plan to within the next 2 to 3 years, and the percentage of companies with undeclared intentions.

Customer interactivity and data-mining are the most obvious sources of implementation to this point, but advanced analytics is leading to not only differentiated offers and pricing, but also a better understanding of customer segments and opportunities. Companies are gradually becoming more proactive in these customer-centric fields, and will need to continue development to reach true digital maturity.

In conclusion

Building an efficient workforce relies on effective processes at the corporate level and contributions at the individual level—each person must be able to exhibit learning and development capabilities, adaption and flexibility, as well as curiosity and openness to change. Replacement of legacy systems has laid the foundation for tomorrow’s growth, and projects will continue in digital innovation, supported by analytics and greater customer segmentation. Businesses that lead the way will be those that evolve and embrace change. However, it’s critical to remember that despite surging digital tools and resources, a company’s ultimate success still comes down to the people you have in place, who will measure and manage the process moving forward.

To learn more about current and future insurance industry trends for 2019, please contact our team.

Related Articles