Brick and mortar bank branches must embrace change. The disruption of the historical approach to branch banking comes with an opportunity for firms to evolve their human capital strategy in in a way that complements the value proposition to both employees and customers.

This article discusses how advancements in retail banking are forcing firms to reevaluate their staffing, role profiles, and longstanding compensation practices for traditional branch roles, specifically the bank teller.

Changing opportunity for branches

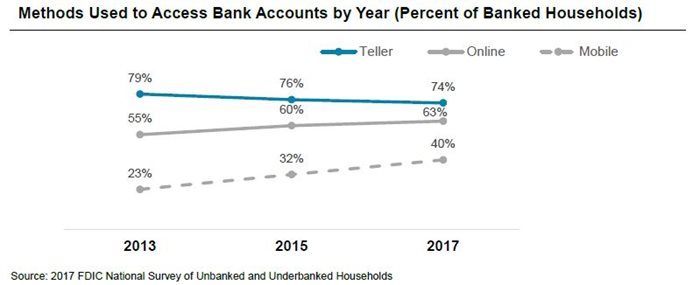

According to the FDIC’s latest National Survey of Unbanked and Underbanked Households, the percent of U.S. banked households (a household with at least one bank account) who accessed their account digitally increased sharply from 2013 to 2017. Surprisingly, the use of bank tellers during this same period saw just a moderate decline. This suggests that while alternative methods of banking are growing in prevalence, the growth is not entirely offsetting in-branch customer service. To put it into perspective, there are still many bank branches in the U.S.—six times the number of Starbucks locations. More importantly, 74% of banked households still accessed their account through a teller at least once in 2017. Interestingly, this highlights an opportunity for firms to shift focus to driving more productive activities through the high-cost brick and mortar channel. Branch employees remain a key influencer of bank sales, brand image, and customer experience.

Branch staffing

Banks are actively reforming their branch experience by leveraging new formats, such as “pods” or workstations instead of teller lines, cafes instead of branches, or smart ATMs instead of people. We even saw HSBC deploy Pepper the Robot at a U.S. branch in 2018. These innovations highlight the need to rethink branch staffing.

The teller role is evolving to deemphasize the historical focus on processing over-the-counter transactions. Teller job descriptions now commonly include educating customers on banking products, self-service applications, and problem resolution. We’ve also seen rebranded job titles. Over 40% of firms in our recent McLagan Retail Pay Practices Study use a title other than teller for this role, such as service associate / specialist or banker. The universal banker, a combined branch sales and service position, started to gain traction in 2013 with the vision to eventually replace all tellers. While we haven’t seen this complete transition, teller headcount as a percent of total branch staff typically reduces by over half for firms that predominantly leverage a universal banker position.

Branch staffing should complement the firm’s retail strategy, yet also be able to adapt to different market needs. Not all branches will have the same level of transactional, sales, and advisory opportunities. Effective training performance management should accompany any branch role transformations.

Modernizing pay practices

Given recent market pressure on salary and incentive practices, aligning the branch pay program with shifting role priorities is critical.

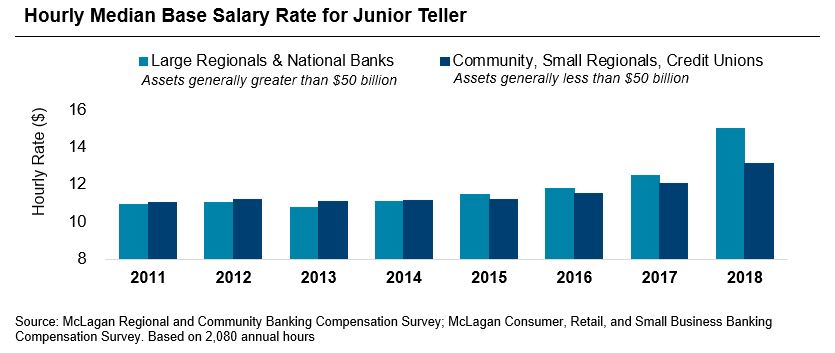

Starting pay was a hot topic in 2018 as a result of both the Tax Cuts and Jobs Act of 2017, as well as city / state minimum wage increases. Many larger firms publicly announced minimum wage increases to $15/hour, which put upward pressure on all industries. McLagan’s 2018 Consumer Compensation Survey showed a 20% increase in median teller base pay for large banks, landing well above historical 3% year-over-year increases. Smaller regional and community banks were less likely to increase base pay depending on the demand within their local labor market. It’s important to also note that firms aren’t only competing with bank branches for teller staff; these skills are transferable to other retail and service industries as well. While increasing base salaries could represent a significant expense for the organization, it is imperative to balance this cost with turnover and recruiting expense.

Increasing base pay for branch staff doesn’t only have implications for entry level tellers. Adjustments for senior tellers and other banker roles continue to be a challenge as firms look to maintain appropriate salary differentiation. In some cases, the additional fixed cost associated with rising base pay has contributed to firms eliminating incentives for tellers all together.

Teller incentives are a small component of total pay, typically less than 5% of salary, and often paid quarterly or monthly. These incentive plans mostly focus on sales activities, such as customer referrals or product cross-selling. The 2016 retail sales practices scandal brought about industry-wide scrutiny of branch sales techniques and goal setting, causing firms to respond with tighter governance of sales practices and incentive plans.

52% of firms in our 2018 Retail Pay Practices Study indicated that they adjusted performance measures in branch incentive plans within the past year. We’ve seen a shifting focus from referrals and transactions to programs that incorporate customer experience, teamwork, compliance, and digital migration. While these measures can help effectively balance sales and service goals, their qualitative nature is often subjective and more difficult to track at the individual level.

To pay or not to pay incentives

Firms need to assess whether their teller pay program effectively drives performance and aligns with the role’s responsibilities. Some key considerations we’ve observed around eliminating teller incentive programs include burdensome plan administration, relatively high reputational risk, small payouts that ineffectively motivate behavior, and affordability.

The removal of variable pay must be balanced with other HR considerations, such as greater differentiation in salary increases, recognition programs, investments in training, and clearer career paths. Only paying a base salary for tellers may also alleviate compression issues, as total compensation opportunities for other roles can be differentiated with incentive eligibility.

Widget-based referral incentive plans for tellers have become outdated. Firms now look to emphasize activities like customer education and experience, while also migrating transactional activities to lower cost digital channels. One tactic used to change these programs is increasing the performance period to semi-annual or annual payouts. This allows for the assessment of qualitative metrics over a longer period, encourages staff retention, and reduces the time and cost of plan administration.

All incentive plans must have controls in place for detecting and responding to improper activity. Incentive plan design and administration should include control functions outside of the business, such as human resources, finance, and risk / compliance.

In conclusion

As branch strategies continue to evolve, so should the human capital strategy. While retail banking may be trending more towards digital transactions, the reality is that most customers still walk into a branch at some point during the year. Therefore, an effective HR strategy for tellers, who comprise 40% of all branch staff, shouldn’t be overlooked.

Key areas for consideration:

Ensure that branch staffing and role profiles align with the strategic direction of your branches

- Is the firm committed to the teller position or phasing it out in favor of a universal role? Appropriate training and development should accompany any branch transformations.

Benchmark salaries relative to local bank and non-bank competition

- Maintain competitive base pay or understand how your firm’s value proposition attracts and retains talent. This differentiation could include variable pay, good benefits, or more frequent promotional opportunities.

Evaluate the effectiveness of teller incentive programs

- Focus on measures that encourage the right behaviors and drive the most value for the firm. If the current plan structure doesn’t accommodate the desired measures, consider a restructuring.

- Establish the appropriate level of performance measurement—firm, branch / team, or individual.

- Determine whether a variable pay program makes sense in the context of current salary levels and small award opportunity.

Maintain a strong governance program to monitor branch goal setting, performance, and costs

- Strong risk review processes should cover all incentive plans of the organization, including retail incentive plan monitoring and back testing.

Our latest Retail Pay Practices Study reports on trends from 50 U.S banks. Contact our team to learn more about evolving retail banking compensation strategies.

Related Articles