The COVID-19 pandemic, and the market volatility it has created, shines a light on some of the pitfalls of using relative total shareholder return metrics in incentive plans. Here’s how companies in Australia can respond to make their plans even stronger.

Relative total shareholder returns (RTSR) remains the most prevalent performance measure for long-term incentive (LTI) plans amongst Australia’s ASX300 companies. To determine the vesting of LTI awards, the total shareholder returns (TSR) of a specific company, comprising share price appreciation and dividends, is compared to the TSR delivered by companies in a specific market index or bespoke group of comparator companies. Proponents say that RTSR aligns an executive’s rewards to their company’s success in delivering excess value to shareholders. But critics claim it’s a flawed metric that is more of a lottery than an incentive.

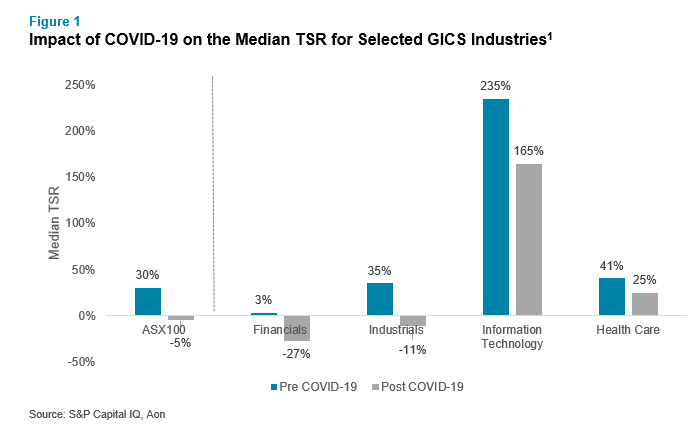

Aon has analysed TSR performance of ASX100 companies before and after the COVID-19-related shutdown. Findings reveal that the impact on share price has varied widely dependent upon industry. Some industries, like consumer staples and healthcare, saw increased activity, while others, such as oil, gas and real estate, have struggled. This is particularly true for those in the discretionary spend sector including airlines, travel and hospitality.

Using this analysis, we examine LTI awards features and RTSR calculation methodologies that may have provided some protection from the full effects of the COVID-19 pandemic on a company’s share price, volatility and RTSR ranking. We share specific examples to illustrate how some of these features could affect the vesting of these LTI awards at the end of the fiscal year of 2020.

The Widely Varying Impact of COVID-19 on TSR Performance

Government lockdown restrictions have taken a toll on the Australian and global economy. The ASX100 Index and ASX Small Ordinaries Index declined by 22% and 28% respectively in the first quarter of 2020.

To illustrate the impact this might have on the vesting results of LTI awards by the end of fiscal year 2020 (June), we assumed a standard three-year performance period commencing July 1, 2017, with ASX100 constituents as the comparator group. We calculated the TSR performance for each starting December 31, 2019, and compared this to the performance at March 31, 2020. We further categorised by Global Industry Classification Standard, determining the median by industry to illustrate the impact of the COVID-19 pandemic on TSR results.

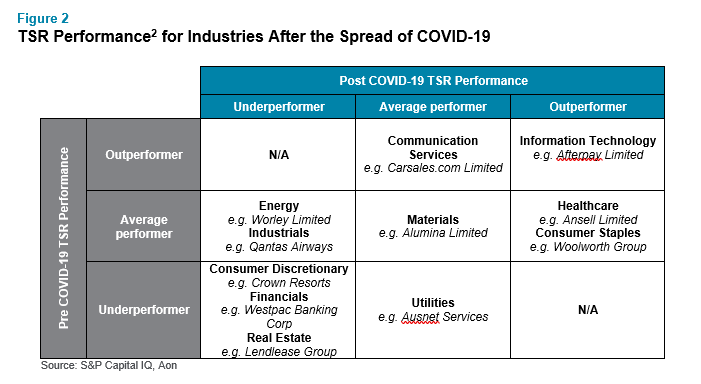

Between this analysis and Figure 2 below, it is clear that the COVID-19 pandemic is disrupting many industries, and its impact on TSR varies widely. To be more specific:

- Airline and travel companies that were tracking with RTSR performance above the median TSR of ASX100 constituents in December 31, 2019, suddenly fell when measured on performance as of March 31, 2020.

- Some of the market stars in the IT sector had significant TSR momentum in the lead up to December, appearing highly likely to maintain their upper quartile rankings and full LTI vesting in 2020, despite significant drops in their share price in March.

- Many banks and financial services companies are trailing behind the median TSR of ASX100 constituents before and after the impact of the pandemic.

- Some companies in the healthcare and consumer staples sectors that were on track for only partial vesting of their LTI plans in the lead up to December are now outperforming the ASX100, with potential full vesting of their 2020 LTI due to increased demand for their essential services.

The Case for Positive TSR

Our July 1, 2017, to December 31, 2019, performance period analysis indicates that just 14% of ASX100 companies were showing a negative TSR. By March 31, 2020, analysis shows that this number increased to 56%. Given that typical market practice is for LTI vesting to commence at the median, this suggests that a small number of companies that are RTSR-tested in 2020 may see partial vesting of their LTI awards.

Among the ASX300 companies, our research indicates that 25% had negative TSR on December 31, 2019, while 52% were in negative TSR territory by Mach 31, 2020.

In response to expectations of investor groups, such as the Australian Shareholder’s Association (ASA), we have seen a very small number of companies implementing at gateway — requiring a positive TSR before any LTI vests, regardless of RTSR ranking. In a bid to address the often-conflicting views of investors and regulators on using non-financial performance criteria for the LTI, the Commonwealth Bank of Australia (CBA) remuneration report shows that a positive TSR gateway correlates with trust, reputation and employee engagement measures. It remains to be seen whether the shareholder experience in 2020 may find other companies under pressure to consider positive TSR as a gateway for vesting of any future LTI awards.

Some LTI Plans Were Better Prepared for the Unexpected

For certain sectors, the COVID-19 market downturn has had a dramatic impact on RTSR and any LTI vesting in fiscal year 2020 seems highly unlikely, particularly when measured against the broader index. However, some of these hard-hit companies might be able to soften the market impact and improve vesting probability if their LTI awards contain certain terms and assumptions. Let’s dive into these points further:

1. The choice of your peer group can make an enormous difference for the LTI vesting outcome.

It is important to put in the time and effort to identify the most appropriate comparator group to ensure that the TSR program is effective and sufficiently robust to withstand the vagaries of the market and unexpected events that might impact different industries in various ways. If comparisons in the same industry are too few or disparate, the plan might be less effective. Outliers or changes in the constituents over the course of the performance period can have a significant impact on the assessment of relative performance, disconnecting LTI vesting from shareholder view of a company’s success.

The financial services industry, for example, has underperformed the broad ASX100 TSR in both performance periods examined. Against that broad index, it would seem unlikely that any LTI will vest in 2020 for executives of most financial services companies. The likelihood of vesting increases if the terms of their 2017 LTI award indicate that a three-year RTSR should be ranked against its peers within the same industry.

When granting LTI awards in 2020, choosing the right comparator group for the next three years will be key. A very broad market index, like the ASX100, will include companies that have been dramatically impacted by the market downturn. Starting price for certain firms in the next TSR performance period will be measured from a low base, in some cases 60% or more below recent highs. In a performance period spanning the next three to four years, it is expected that the turnaround of these companies, as well as companies that are a commodity play, would have a better chance of topping relative TSR performance tables. There is even a possibility of slow return to their prior financial performance. In this scenario, companies whose share price has remained stable in 2020, or those with sustained high growth, will likely struggle to be competitive against a broad index. For these essential services companies, a bespoke comparator group of a sufficient size may more effective in aligning performance and rewards.

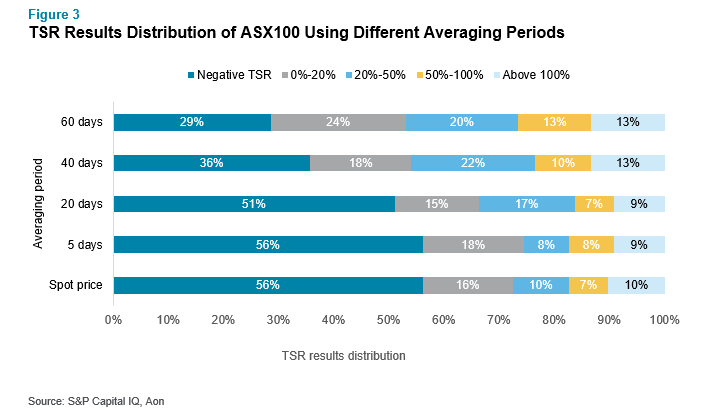

2. A longer averaging period in the relative TSR calculation could smooth volatility associated with COVID-19.

When calculating TSR, some companies choose to apply an averaging period at the beginning and end of the performance period to smooth out any short-term fluctuations in the share price. We have observed companies adopting average periods ranging from five trading days to six calendar months.

While a five, 10 or even 20-trading day averaging period would typically suffice for companies with low share price volatility, it may not be sufficient to smooth out the instability caused by the COVID-19 pandemic. More than 50% of the ASX100 would have had a negative TSR result by the first quarter of 2020 using a spot price for the TSR calculation. However, less than a third would receive a negative TSR result if an averaging period of 60 trading days was used for the calculation (Figure 3). Given that the COVID-19 pandemic began to impact the ASX market around mid-February, it is not surprising that using a longer averaging period yields better results for most companies.

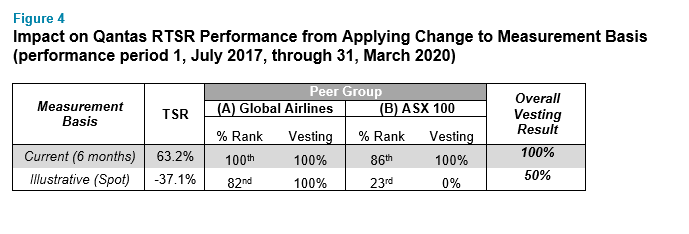

The impact of the selection of an appropriate averaging time period is best demonstrated through the following example. Qantas’ long-term incentive plan is assessed over a three-year performance period against market-based conditions. Relative TSR performance is assessed against the broad ASX100 market index and a bespoke comparator group of international airline peers, with both peer groups equally weighted. Qantas applies a six-month averaging period to its TSR calculation.

There is no doubt that the COVID-19 pandemic has seriously disrupted the airline industry. The combination of trip cancellations and country-specific restrictions on international flights has taken its toll. The outlook of the industry is reflected in the sharp decline of Qantas’ share price in the first quarter of 2020. If a spot price was applied to the RTSR calculation, Qantas, whilst still outperforming international airline peers, would not receive any payout based on its performance relative to the ASX100 companies at the end of the first quarter in 2020. However, using its current six-month averaging period to smooth out the recent price fluctuation, Qantas would achieve 100% vesting under the plan (Figure 4).

The Devil is in the Detail

Without knowing when business will be back to normal, remuneration committees may find it extremely challenging to identify, set and calibrate the financial metrics needed to grant LTI awards later this year. For example, an ASX100 company that previously issued LTI awards with dual EPS and RTSR hurdles may find that the EPS vesting scale is not appropriate to apply to this year’s LTI grants. If FY2020 EPS was hit hard by the COVID-19 economic downturn, investors may have higher expectations in terms of annualized growth over three years. With such uncertainty, RTSR measured against a comparator group of companies with a comparable COVID-19 experience is likely the best default measure.

Designing an effective RTSR measure is an intricate process that involves close attention to detail. Certain key LTI design features, technical RTSR calculation methods and assumptions can be easily overlooked and later regretted. As previously illustrated, some companies may have softened the impact of the COVID-19 market crash through their choice of comparator group and use of longer averaging in the TSR calculations.

We believe there are also other strategies that companies can use to improve RTSR effectiveness as an LTI measure, minimising the “lottery effect” and helping to mitigate unexpected events. When setting the terms of LTI offers in 2020 and beyond, it’s important to include the following:

- Performance period: The most common performance period amongst ASX100 remains three years. However, a shift to a longer performance period is observed in banks. With the impact of the recently implemented BEAR and APRA reviews, we anticipate a shift from three- to four-year performance periods across industries beyond just the banking sector. Research shows that RTSR is better correlated to business performance when measured over a period of four years or more.

- Participation: Limit the participants to people with direct ‘line of sight.’ KMPs are responsible for setting strategy for their companies where their decisions typically have a three to five years impact. Relative TSR does not align with senior and middle management, who are strategy implementers rather than strategy developers. The trend is for these lower levels to receive an annual incentive delivered in a mix of cash and deferred equity, rather than the traditional STI and LTI.

- Vesting: Construct the appropriate vesting schedule to measure relative performance and rewards outcomes. Standard rule has vesting between the 50th and 75th percentile, while some less volatile companies and blue-chip dividend plays could vest between median and median plus a certain percentage. Many long-term, income-oriented shareholders may prefer companies that are consistently delivering alpha above median, rather than increasing their risk profile to chase upper quartile growth.

- Room for discretion: A rigid formulaic application of RTSR can, and sometimes does, result in unfair rewards and inefficient incentives. It’s important to have both a policy and process for reviewing measures at the end of a performance period, as well as a framework for applying discretion in the event of extraneous events or anomalies. As with any use of discretion, the rationale must be transparent and defensible.

- TSR calculation methodology: Other than setting an appropriate averaging period, there are many more factors that need to be taken into consideration, such as how to manage delisted companies, how to manage changes to index constituents during the performance period, should the target company be included for percentile purposes, when and how are dividends reinvested, etc.

- Communication and real-time alignment: With the rapidly evolving situation of the current COVID-19 pandemic, people are working indefinitely in isolation. It has become increasingly important to communicate more frequently with the stakeholders to ensure that senior executives remain engaged during this uncertain time. Rather than waiting until the end of a performance period to receive the payout result, a live TSR tracker can help participants engage better with TSR performance.

Next Steps and Additional Resources

Without knowing when and if business will go back to normal, companies currently on a RTSR plan should consider revisiting its design efficiency to minimise the ‘lottery’ effect and help mitigate unexpected events. For firms that have not yet adopted a RTSR plan, now is the perfect time to rethink your LTI plan design, as RTSR will likely be the only reliable relative measure during the uncertain road ahead.

To learn more about long-term incentive plans and how Australian firms are approaching compensation during the COVID-19 pandemic, please speak with a member of our rewards consulting group or write to rewards-solutions@aon.com.

To read more articles on how rewards professionals can respond to the COVID-19 pandemic, please click here.

To download complimentary results of our latest pulse survey on Setting the Stage for a Return to Work and the New Normal, please click here.

COVID-19 Disclaimer: This document has been provided as an informational resource for Aon clients and business partners. It is intended to provide general guidance on potential exposures, and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, Aon cannot be held liable for the guidance provided. We strongly encourage visitors to seek additional safety, medical and epidemiologic information from credible sources such as the Centers for Disease Control and Prevention and World Health Organization. As regards insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the insurance policies and contracts at issue and underwriter determinations.

General Disclaimer: The information contained in this article and the statements expressed herein are of a general nature and not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without the appropriate professional advice after a thorough examination of the particular situation.

Related Articles