While ESPPs are well known, there is a lack of data on just how common they are. Our new research can help firms decide if they should offer one based on industry, region and size

Employee Stock Purchase Plans (ESPPs) typically provide an opportunity for employees to periodically purchase discounted company shares using payroll deductions. As such, ESPPs represent an easy and effective way of generating more employee owners in the company, essentially aligning more of the population with shareholders. And, unlike full-value shares or stock options that tend to be targeted to individuals responsible for more immediately impacting a firm’s stock price performance and often come with a significant expense, ESPPs are relatively inexpensive and intended to be available to a broader employee population.

Given these benefits, it is no surprise that ESPPs are a common discussion point with companies analyzing ways to benefit both employees and the business. It turns out that despite how well-known ESPPs are, there is a lack of reliable data as to how prevalent they are offered among companies in the United States (U.S.). Given this lack of data, some companies are unsure if their competitors are offering one and if it’s a good idea for them to. To find the answer, we gathered data on ESPP offerings covering the S&P 500 and the Russell 3000 as well as contributions from the National Association of Stock Plan Professionals (NASPP) and Fidelity Stock Plan Services.

We chose to analyze the S&P 500 and the Russell 3000 to specifically cover two iterations of the U.S. market, both high-profile, large cap companies and a broader representation that can serve as a proxy for the U.S. market. We did not analyze private companies as the data is not public and, from our experience, it is uncommon for private companies to maintain ESPPs. Our data was gathered through November 30, 2019, representing active plans in 2019.

Correctly identifying the number of companies offering ESPPs to employees is a challenging process and we should note that the findings in this article may contain a small margin of error due. That’s because of limitations inherent in identifying ESPP prevalence due to issuers’ varying compliance with corporate financial reporting. To limit error, we employed multiple data collection, verification and confirmation methods that first involved searching for evidence of active ESPPs in financial reporting documents and, secondarily, disclosure on companies’ websites. We validated our findings using the ISS Governance Analytics tool and dataset. The data includes both compensatory and non-compensatory plans.

Overall, we found that 49.0% of S&P 500 companies and 38.5% of Russell 3000 companies offer an ESPP to their employees. More interestingly, we uncover greater differences by analyzing ESPP prevalence by industry, region, company size and employee headcount.

ESPP Prevalence by Industry

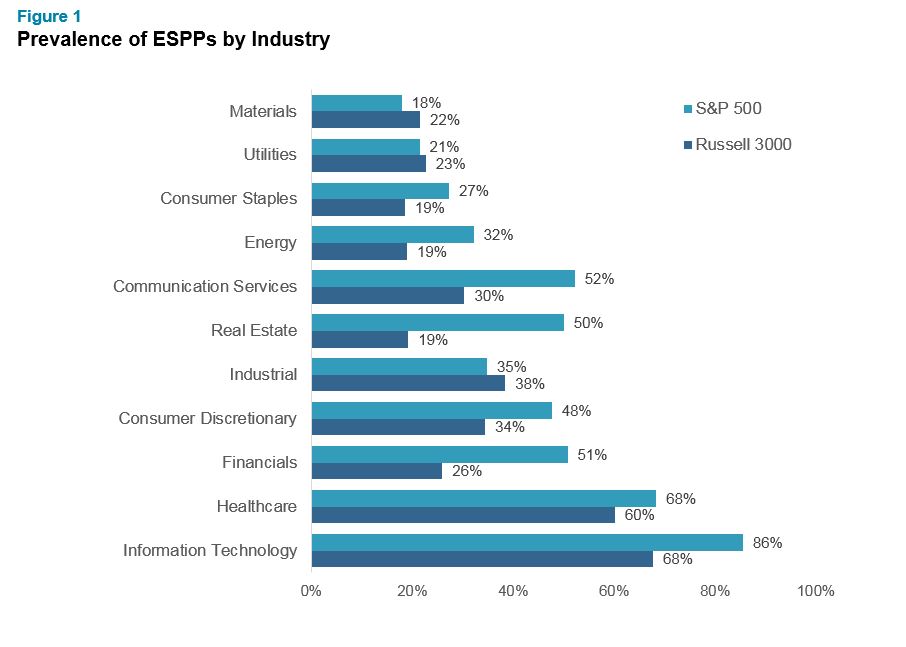

To develop an understanding of company characteristics that might influence ESPP offering rates, we analyzed companies’ demographic details, starting with industry sector. For both the S&P 500 and the Russell 3000, Information Technology and Healthcare are the sectors most likely to provide ESPPs, which is not surprising given the culture of equity compensation within these industries. In the S&P 500, 85.5% of Information Technology (GICS 45) companies and 68.3% of Healthcare companies (GICS 35) offer ESPPs to their employees. Similarly, in the Russell 3000, 67.7% of Information Technology companies and 60.2% of Healthcare companies provide ESPPs.

On the other end of the spectrum, within the S&P 500, the sectors least likely to offer ESPPs are Materials (18%), Utilities (21%), and Consumer Staples (27%). The Russell 3000 companies least likely to provide ESPPs are located within the Consumer Staples (19%), Energy (19%), and Real Estate (19%) sectors.

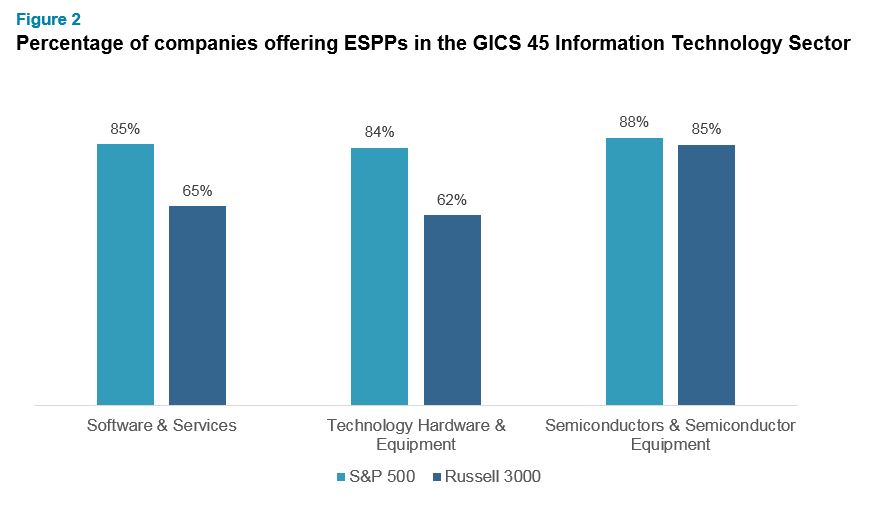

Upon deeper examination, we find that within the Information Technology sector, in the S&P 500, firms from all three subsectors, Software & Services (GICS 4510), Technology Hardware & Equipment (GICS 4520), and Semiconductors & Semiconductor Equipment (GICS 4530), are equally likely to offer ESPPs to their employees. However, in the Russell 3000, companies within the Semiconductor & Semiconductor Equipment subsector are more likely to provide ESPPs than those in the other two subsectors. More details can be found in Figure 2 below.

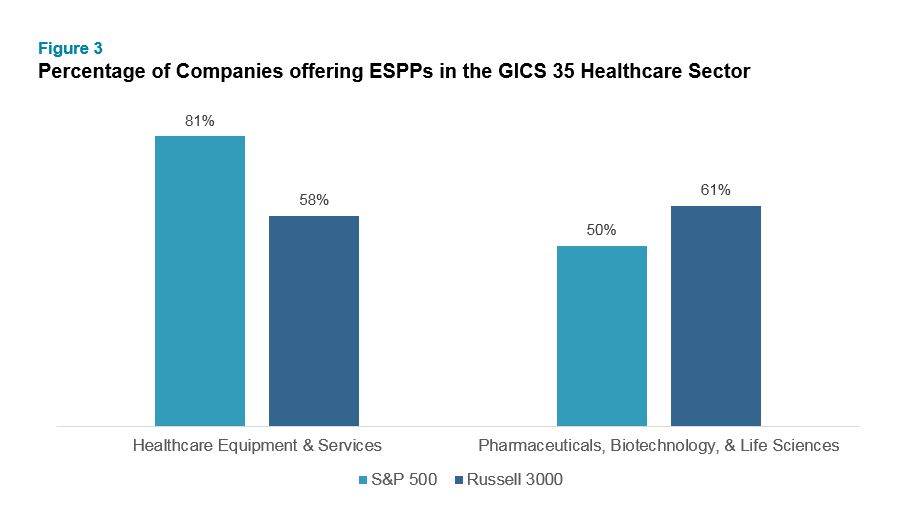

We also observe differences among subsectors across the S&P 500 and Russell 3000 for the Health Care sector. Among S&P 500 companies, firms within the Healthcare Equipment & Services subsector (GICS 3510) are significantly more likely to provide ESPPs to their employees than firms within the Pharmaceuticals, Biotechnology & Life Sciences subsector (GICS 3520). However, for the Russell 3000, the relationship is reversed with a slightly more Pharmaceuticals, Biotechnology & Life Sciences companies offering ESPPs than companies in the Healthcare Equipment & Services subsector.

ESPP Prevalence Based on Region

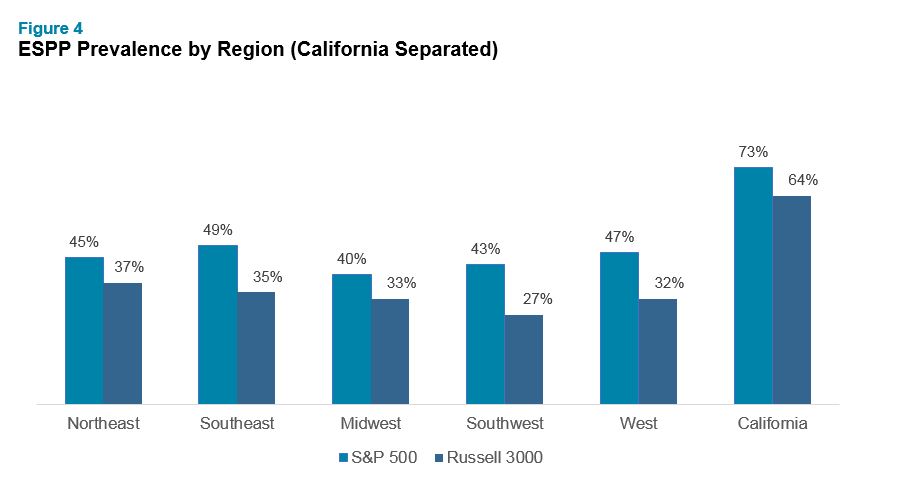

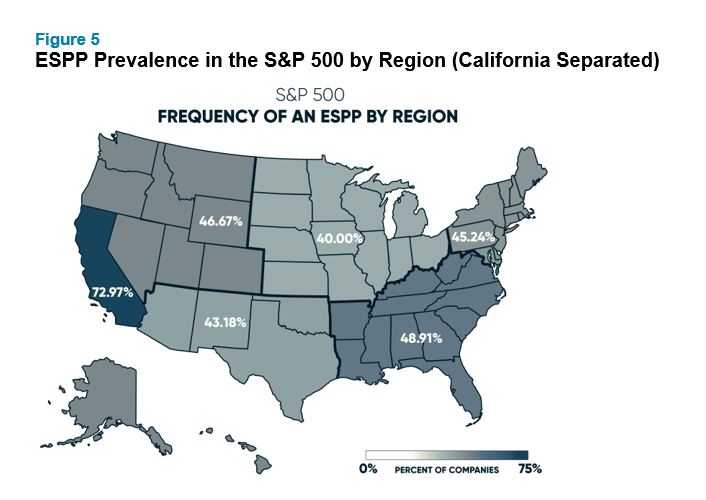

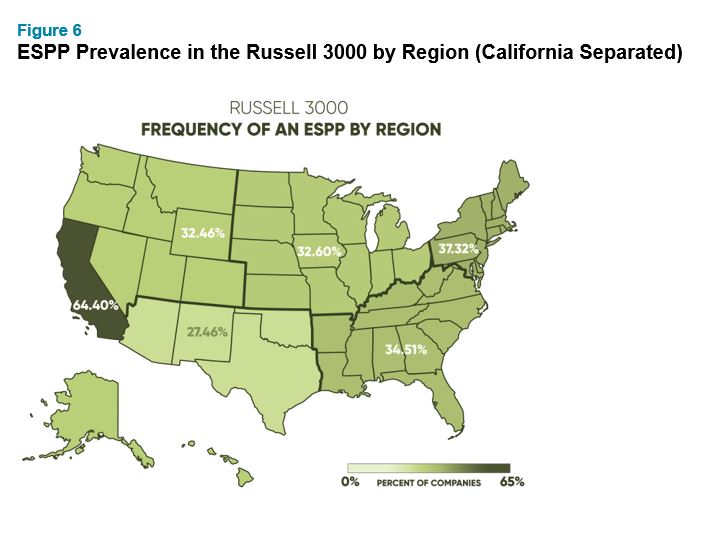

When we analyze the data based on regions within the U.S., we find that firms headquartered in California are far more likely to offer ESPPs than any other location within the United States. This is not surprising given the concentration of technology and life sciences companies in California, which tend to have a bigger equity culture than many other sectors. This trend is consistent for both the S&P 500 and the Russell 3000. Note that in Figure 4 California is listed separately from the west region because ESPP prevalence rate in that state skews the data.

Looking beyond California, the states with the highest percentage of companies offering ESPPs are New York, Massachusetts and Texas. Figures 5 and 6 highlight the percentage of companies in the S&P 500 and Russell 3000 respectively that offer ESPP plans to their employees.

ESPP Prevalence by Market Cap

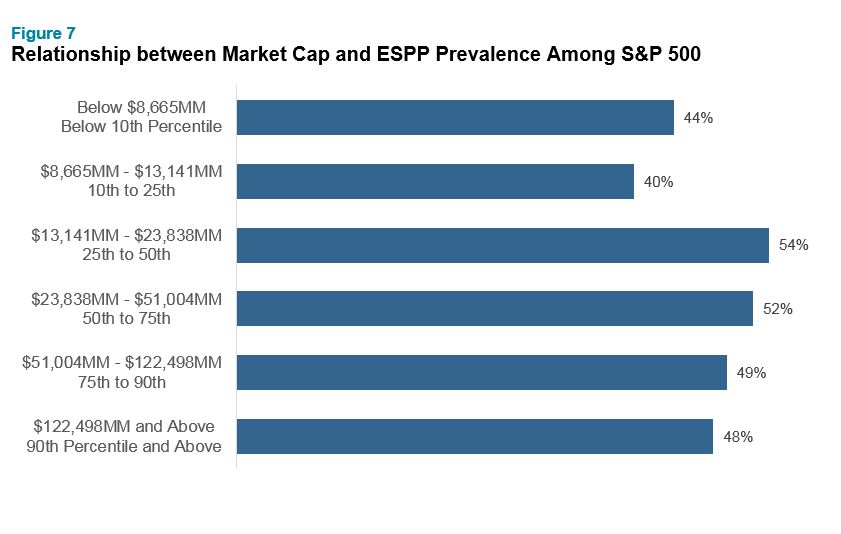

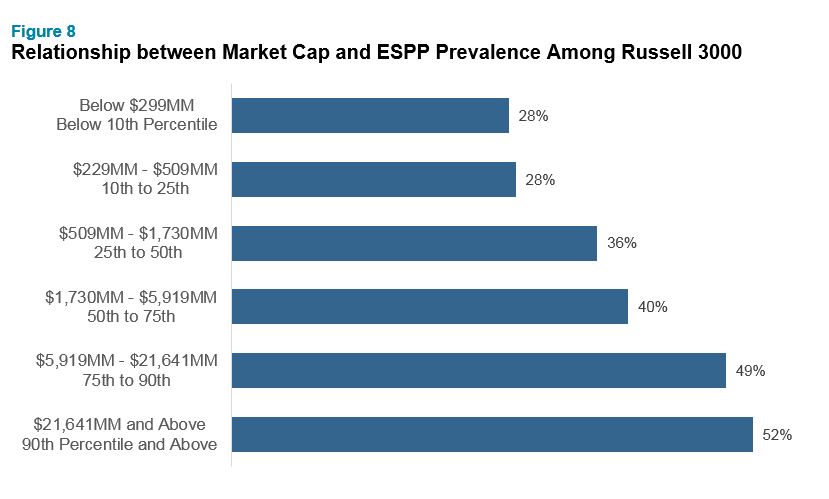

In addition to reviewing GICS sector and region, we filtered the disclosure of ESPPs in proxy statements by company size to determine whether there is a correlation between company size and ESPP prevalence. Among the Russell 3000, companies with a larger market cap are more likely to offer an ESPP. However, we don’t see the same correlation for the S&P 500 where there is a more equal distribution throughout market cap percentiles. This seems explainable considering the companies in the Russell 3000 cover a broad range of market caps, while the companies in the S&P 500 are all organizations with larger market caps.

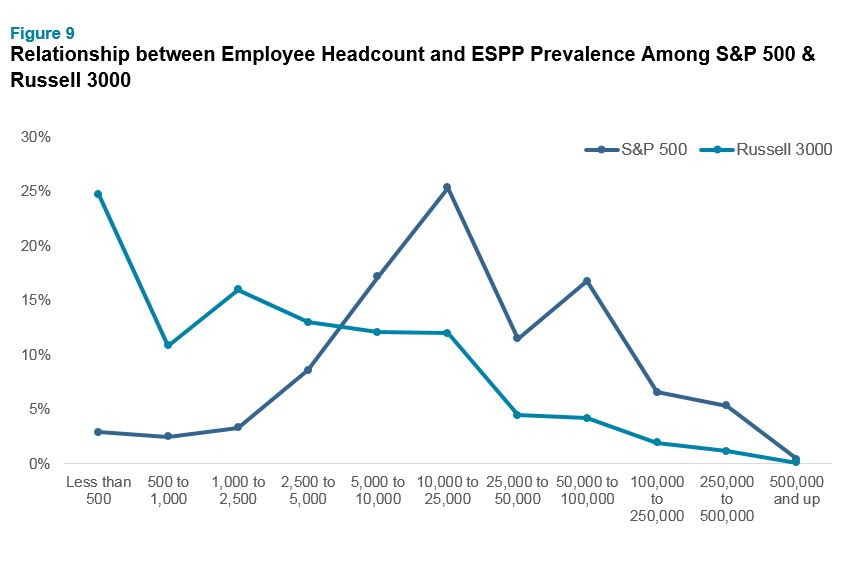

ESPP Prevalence by Employee Population

To further assess prevalence by company size, we analyzed the use of ESPPs by employee population to understand if there was a “right size” for effective programs. Interestingly, we see companies with smaller populations maintain a higher percentage of ESPPs within the Russell 3000, while companies with employee headcounts between 5,000 and 100,000 seem to have the highest percentage of ESPPs within the S&P 500. Given the structure of the Russell 3000, it’s not surprising to see companies with smaller populations utilize ESPPs more as it is an extremely effective and efficient method to creating broad-based employee ownership; however, it is interesting to see the “sweet spot” for larger companies tends to be between 5,000 and 100,000 employees.

Next Steps

The analysis provided in this article is the first step in gaining an understanding of the prevalence of ESPPs within the U.S. In future analyses, we plan to examine the relationship between ESPP offerings and firms’ TSR data as well as assessing the correlations between ESPP plan design components and company demographics. We would like to acknowledge the contributions of Barbara Baksa of the NASPP and Emily Cervino Fidelity Stock Plan Services to this research and look forward to partnering on future analyses.

If you’re looking to offer an ESPP or are exploring ways to better manage your existing plan and have questions, please reach out to one of the authors or write to rewards-solutions@aon.com.

Related Articles