Putting effort into benchmarking your firm’s pay against relevant industry peers will make long-term compensation planning more effective.

When your company participates in salary surveys, completing data collection forms may not always seem like the most important task on your desk, particularly in a turbulent environment and periods of growing economic uncertainty. However, investing time into completing them accurately will pay dividends down the road when using survey data to competitively benchmark your rewards programs against the market. This is especially true in times of market volatility. Throughout the year, it’s crucial to consistently review your organization’s base pay, understand if your firm is achieving its compensation philosophy and goals, and determine whether your salary structure is still aligned to the market.

In this article, we provide tips for taking the proper steps to ensure you have reliable and relevant benchmarks for whatever the future holds.

Benchmarking – Why Is It Important and How Do You Do It Well?

The phrase “garbage in, garbage out” applies to many types of data, and compensation survey data is no exception. Taking the time to match your jobs to the correct survey positions is a critical component of ensuring trusted results. If you aren’t conducting due diligence on the front-end, your results will have little value.

Take, for example, Rewards Solutions compensation surveys. Our surveys provide robust specific peer groups and access to broader industry data using a globally consistent survey structure. In addition, participants receive custom results that show their firm’s employee compensation data side-by-side with its market benchmarks. They also focus on the individual components of compensation, such as salary structures, incentive grant practices, etc. To reap the full benefits of the survey results, a concise job matching process is of vital importance and ensures a clear and accurate view of your firm as compared to the market. It’s worth getting it right.

Our experts recommend the following as you begin matching positions to the best possible benchmark job in surveys:

- Read the survey job descriptions – While many jobs will be near perfect matches, you may have unique positions that don’t quite match to a survey job. We recommend matching an incumbent to a survey position if there is at least 70% overlap between the job’s duties and the description of the job in the survey materials.

- Benchmark the role, not the incumbent – Often, specific incumbents will have much more experience than is required for the job. Read through your own job description for the position and consider the level of experience needed if you were to backfill the role.

- Use the materials provided – Use all the tools and resources available to you. For example, Rewards Solutions provides several training sessions, videos, and reference guides to help with the job matching process.

- Collaborate with management – Managers within your firm’s business units are often well equipped to articulate the differences between the positions reporting to them. Use their expertise when trying to parse through similar survey job descriptions.

- Ask for help – It is in everyone’s best interest that jobs are benchmarked as accurately as possible. While filling out survey data collection can be time consuming and difficult, survey teams are always available to get on the phone and walk through your positions to try to find the best fit. Our survey participants are assigned a relationship manager that is available to support your firm throughout the entire survey process.

Compensation Philosophy – How Does Your Pay Strategy Align with Market Benchmarks?

Survey results will help you understand where you are currently paying compared to market, but an equally relevant question is, where do you want to be paying? This is where your firm’s compensation philosophy comes into play.

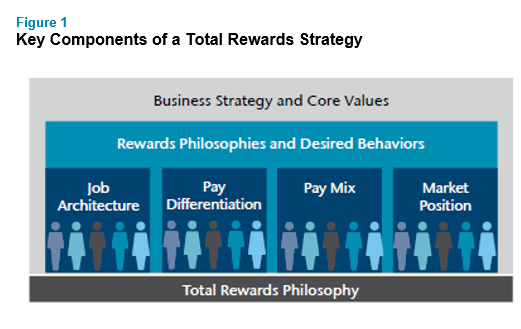

A detailed, actionable compensation philosophy that is specific to your organization is helpful in guiding compensation decisions throughout the firm. Businesses often have overly broad pay philosophies that do not provide enough direction to serve as a consistent framework for decision makers to follow. Strong compensation philosophies should provide guidance on the following three questions:

- How do your mission and values align to compensation? (Do you want to be an organization that meets, leads or lags the market?)

- What is your targeted market position? (50th or 75th percentile? Should it vary by business or position?)

- What is your compensation mix? (What is the proportion between fixed to variable pay?)

Having a comprehensive employee compensation strategy requires alignment across key elements of your firm. And having industry-aligned data and an understanding of your firm’s position in the market, provides you with the qualitative insights needed to make informed, data-driven decisions.

Salary Structure – Are Your Pay Grades Aligned to Benchmarks?

A salary structure is an organization’s internal representation of the external market. Most firms have some form of structure in place to organize their jobs and administer pay. Once you have settled on your compensation philosophy and received market data from your survey(s), you will be able to evaluate your current salary structure. Benchmarking your positions accurately makes this task easier because it will allow you to use market data with confidence as you evaluate where to slot jobs into the structure later in the year.

Here are two key ways to strategically review your existing salary structure using survey data:

- Individual job evaluation – For each job, review the midpoints of your ranges and the targeted market position outlined in your compensation philosophy for alignment to market data. Typically, that targeted market position is the midpoint of the range. Jobs may need to move up or down a grade depending on how the market data moved year over year.

- Full salary structure evaluation – Compare market data, your compensation philosophy, and your salary grade midpoints for all jobs to determine whether your current structure is working towards your compensation goals. To learn more and gain further insights on the topic, read our article, Top 5 Ways to Maintain Your Salary Structure.

It is crucial to ensure that you are benchmarking your positions to the correct survey match now. Inaccurate benchmarks will result in pay grade alignment errors. This puts you at higher risk for retention and hiring issues since your internal grades do not properly reflect market pay practices.

Key Takeaways

The best way to prepare for uncertainty is to take advantage of the concrete data that is already out there, and use this information to compare, recalibrate and, in the end, ensure your business is fully equipped for any challenges that arise. Here are a few key takeaways to remember:

- Market data informs almost every key decision that compensation professionals make.

- Utilizing accurate market data requires you to select the right survey benchmarks for your positions.

- Executing your organization’s compensation strategy successfully is possible because your organization is properly benchmarked to the survey.

- The market is constantly moving, especially now. Ensuring that you have access to the most current information is critical.

Whether you are comparing specific jobs against market data, defining your compensation philosophy, or evaluating a salary structure, proper benchmarks provide the competitive edge and trust you need to successfully execute your firm’s compensation strategy throughout the entire year ahead.

If you’d like to learn more about effective benchmarking for compensation planning, please contact us at rewards-solutions@aon.com.

Related Articles